8 steps to choosing a health insurance plan

How much life insurance do I need?

Your ability to earn income is often your greatest financial asset. But an unexpected injury or illness that keeps you from working for an extended period of time can jeopardize this asset.

Without a stable source of income, your best-laid plans — education savings, mortgage payments, retirement goals — can fall like dominos. If you can’t work due to a health issue, long-term disability insurance can provide a source of income.

Long-term disability insurance is there to protect you if you’re unable to work because of an accident, injury or illness. If you’re a small business owner, certain policies may also protect your business and reimburse any covered expenses incurred during your disability. This can help you avoid depleting your emergency fund or retirement savings if something happens.

If your ability to work is hampered by a disability and you have dependents, like a spouse or children, you want to make sure you’ll be able to pay for your healthcare and living expenses, as well as maintain your lifestyle and savings goals.

Still, many people tend to forego long-term disability insurance. If you’re relatively young and don’t have a history of health problems, long-term disability insurance might seem unnecessary.

But consider the following:

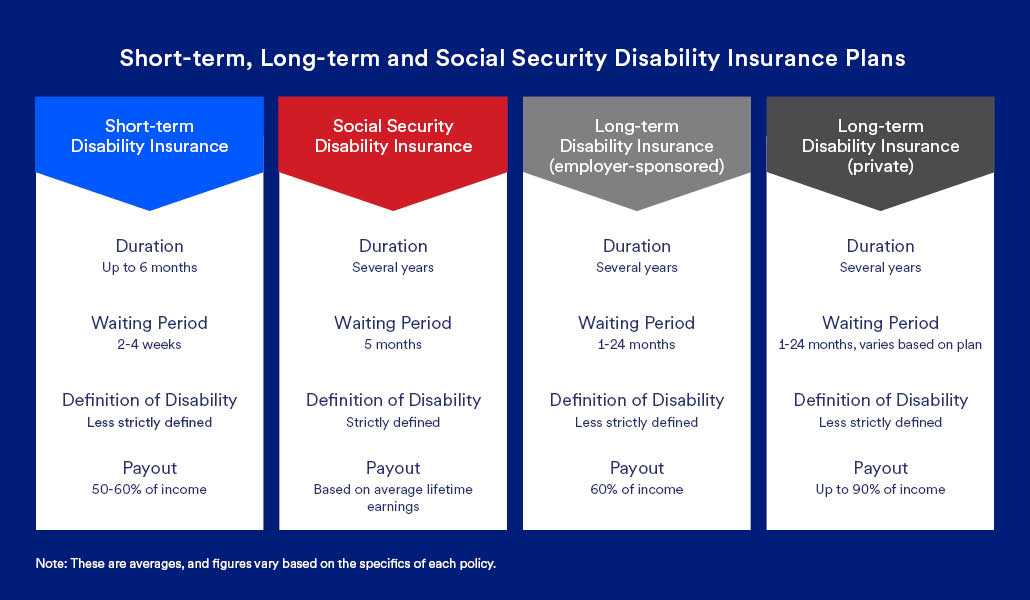

This is where you might have questions. What qualifies as a “disability”? How much does a plan cost? How much income will it provide in case of injury? The answer is: it depends on the plan.

Many private businesses offer long-term disability insurance plans to their employees as part of a larger benefits package, including healthcare and workplace retirement plans. Employees typically pay a portion of the cost.

However, just 34% of U.S. employees in private industry have access to employer-sponsored disability insurance coverage.2 And, even if you do have access it, keep the following in mind:

An individual long-term disability insurance policy can be used to supplement employer coverage or provide coverage if you don’t have access to an employer plan.

In terms of cost, you can expect to pay 1 to 3% of your annual salary for an individual policy.3 However, your premium is determined by several factors, including:

Occupation: the riskier your job, the more expensive the premium.

Age: if you purchase an individual policy when you’re younger, you’ll pay less.

Elimination period: the shorter the period between injury and payout, the more you’ll pay.

Amount paid out: if you want to receive more income in the event of disability, the premium will rise.

Duration of plan: the longer the plan, the more it will cost.

Employer-sponsored long-term disability insurance policies will have different definitions of disability, so it’s important to review your policy’s terms and conditions to see which medical conditions are covered.

In general, disability insurance covers illnesses or injuries that prevent you from working for an extended period, such as chronic pain, cancer, heart disease, mental health issues, and more.

An individual disability insurance policy lets you customize the definition of a qualified disability if you’re unable to perform the duties of your “own occupation.”

The length of long-term disability insurance coverage you receive will depend on your policy. The average length is 2-10 years; however, some policies may provide benefits until you reach age 65, 67 or retirement age.

Keep in mind that the longer the benefit period, the higher your premium will be.

One of the benefits of purchasing an individual disability insurance policy is that you can define the elimination period, which is the amount of time you must wait to receive your benefits after an illness or injury.

The elimination period for employer-sponsored disability insurance is generally 30 days to 2 years.

Whether you’re already covered by an employer-sponsored policy or not, individual long-term disability insurance may help you in case the unthinkable happens. Consider talking with a financial professional to discuss how a long-term disability insurance policy can help protect you in case of injury or illness.

Learn more about insurance options from U.S. Bancorp Investments.

Related content

1 Council for Disability Awareness.

2 “Employee access to disability insurance plans,” U.S. Bureau of Labor Statistics.

3 “Your guide to long-term disability insurance,” Policygenius.

4 “Elimination periods in disability insurance,” Policygenius.

5 “How much disability insurance can be bought?,” Investopedia.