7 ways to teach your children to be smart about online scams

How to keep your assets safe

Here are some considerations for how to structure your business, depending on how many stakeholders you have and what level of personal liability you want.

You did the hard part: You started a business, kept it running and maybe even grew it a little bit. Now, you’re looking more closely at how it’s structured. Would it benefit you to be an S corporation? What about a C corporation? How did you write your bylaws? Knowing the basics of different business structures can help you compare them and make the best decision for your business.

Sole proprietorship

This is the most basic form of business: It doesn’t require you to register with your state or the federal government. However, legally you represent your business as a sole proprietor — the business is run under your Social Security number — so your business’s assets and liabilities are the same as your own. If someone sues your business, your personal assets are at stake.

Limited liability company (LLC)

As the name suggests, forming an LLC limits your personal liability by separating your personal assets from your business assets. If a client were to sue your business, your personal assets are mostly protected. These companies are often “pass-through” entities, where any profits or losses from your business can be counted as personal income — meaning you pay personal income tax rather than corporate tax.

Partnership

There are two types of partnerships — limited partnerships (LP) and limited liability partnerships (LLP).

C-corp

Corporations, also known as C-corps, are the most basic form of corporation. The business is a legal entity that’s entirely separate from its owners. The main difference between corporations and the previous structures is taxation. Corporation’s profits are taxed separately. Corporations also require more formalized record keeping and processes. This is often the go-to structure for companies that plan to sell equity or eventually go public.

S-corp

S-corps are structured similar to C-corps, but like an LLC, profits can be counted as personal income by the owners, effectively avoiding corporate taxation. The IRS restricts which companies qualify as S-corps (for instance, you can’t have more than 100 shareholders) and not all states recognize S-corps the way the federal government does.

Where to start

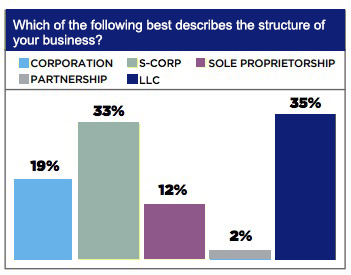

Source: National Small Business Association 2017 Year-End Economic Report

To decide which of these structures might work best for your business, start with these questions:

Of course, there are a number of additional factors involved when deciding how to structure your business. But understanding the basics, including the similarities and differences of the various structures, can help you prepare as your business takes off.

For more on how business entities are taxed, read the essential business tips for tax deductions.

Related content