6 essential credit report terms to know

How to improve your credit score

Your credit history and credit score are some of the most important numbers in your financial profile. These numbers determine whether banks will lend you money, how much and at what rate.

As a U.S. Bank mobile and online banking customer, you can check your credit score as often as you like with our free program powered by Transunion.1

To build and maintain a good credit score, follow these five steps.

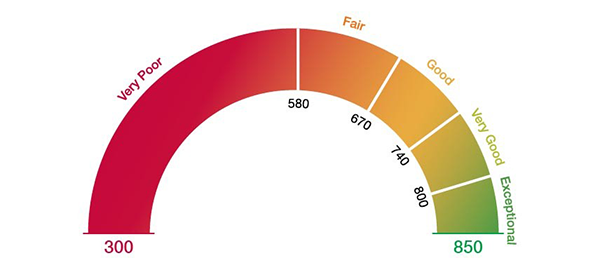

Most credit scores are tallied by companies like FICO (Fair Isaac Corporation), an analytics software company that developed the original credit score model, and are known as FICO scores. Scores generally range from 300 to 850, with higher numbers representing more credit worthiness.

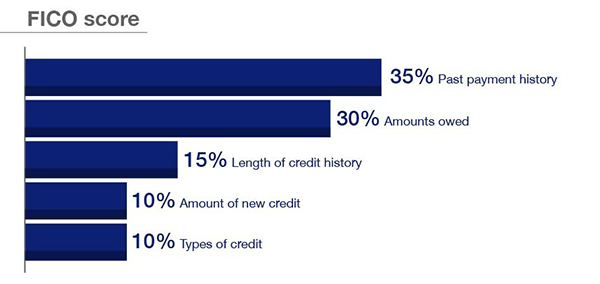

Your FICO score is calculated based on your credit reports, which are compiled by credit bureaus like Equifax, Experian and TransUnion. Specifically, five criteria go into a FICO score:

Whether or not you pay your bills on time has the biggest impact on your FICO score. Not surprisingly, recent late payments affect your score more than late payments in the past, and a habit of missing payments affects your score more than one or two misses. Even if you have a history of missed payments, it’s possible to get back on track. Try to pay at least the minimum on any credit card balances, and consider setting up automatic payments or alerts to help you keep up with due dates.

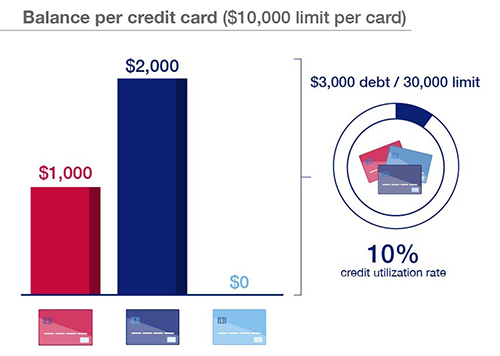

Your FICO score takes into account how much money you owe, which for secured loans, like a car loan or a mortgage, is how much of the original loan you haven’t paid off. Assuming you’re making payments on time for those credit types, the number that’s most likely to be emphasize is the amount of money you owe on any revolving credit accounts, like credit cards.

Additionally, a FICO score considers how your money owed compares to the amount of credit you have access to. This is known as your credit utilization rate.

So, suppose you have three credit cards, each with a $10,000 limit. If you currently have $3,000 in credit card debt, your outstanding debt is 10 percent of your credit limit.

Generally speaking, the lower this number is, the better. Experts recommend keeping your credit utilization rate below 30 percent.

If your credit utilization rate is higher than that, try to come up with a strategy to pay down your credit card debt. Budgeting tools can help you analyze your spending and see where you might be able to cut back, freeing up cash to help you pay down your debt. Debt consolidation can reduce your monthly payment obligations, but it can also impact your credit score depending on the type of debt consolidation credit you do and your ability to pay it back.

Every time you apply for new credit, whether it’s a credit card or a loan, that inquiry ends up on your credit report. Lenders might be concerned if you’ve applied for a lot of credit in a short amount of time. However, the companies that calculate your credit score can usually determine the difference between multiple inquiries on a single loan — say, when shopping around for the best mortgage rate — and applying for multiple lines of credit.

It’s also good to think carefully before closing credit card accounts. For instance, in the example above, if you closed the card with no balance, your credit utilization rate jumps from 10 percent to 15 percent.

Plus, if you’ve had a credit card for a long time, closing it could affect the length of your credit history. Your FICO score takes into account how long you’ve been borrowing money, as well as the average age of your accounts.

Paying down your debts or working to improve your payment history doesn’t happen overnight. However, taking steps to raise your credit score can be one of the most important decisions in your financial life; lenders, landlords and potential employers are just a few of the people who might check your credit score. Keep in mind that good habits, like consistently making on-time payments and chipping away at your debts, are the best way to improve and maintain your score.

It’s also a good idea to check your credit reports regularly. You can get a free copy from each of the three major bureaus every 12 months. Review your report to make sure all of the information is accurate and to keep track of your credit profile.

Find more resources on establishing credit to build your history and be ready for credit when you need it.

Related content

1Free credit score access, alerts and Score Simulator through TransUnion’s CreditView™ Dashboard are available to U.S. Bank online and mobile banking customers only. Alerts require a TransUnion database match. It is possible that some enrolled members may not qualify for alert functionality. The free VantageScore® credit score from TransUnion® is for educational purposes only and is not used by U.S. Bank to make credit decisions.