6 essential credit report terms to know

How to improve your credit score

Applying for credit can feel like a mystery. You submit an application, cross your fingers and hope you’ll be approved. But what happens in between? How do lenders decide who gets credit and how much they get? Here’s what you need to know.

When you apply for credit, you’re asking a lender to take a risk on you. Beyond simply asking for money, the application process is about demonstrating your ability to pay that money back.

In considering your application, lenders look at a variety of factors, including your history with credit, your income and any current outstanding debts. The key factors in assessing credit worthiness are often called the five Cs, and they reveal a lot about why some people have no problem getting access to credit while others get declined.

Lenders use the information in your credit report to determine your credit score, a shorthand way to identify credit worthiness.

Here are the 5 C's of Credit:

1. Character

Lenders want to know they can trust you to pay them back on time and in full plus any interest they charge. As they review your application, they look for clues to your financial character.

A record of paying bills on time, continuous employment and living in one place for a significant amount of time are all signs that you may be a responsible, stable individual who will follow through and pay back what you borrow.

If you have a lot of late payments or overdue bills, or if your employment history is spotty, the other four C’s become even more important.

2. Capacity

Beyond your likelihood to pay them back, lenders want to know if you have the financial resources to cover your debts. To assess this, they look at the income you earn, your employment history and your track record of borrowing money and paying it back.

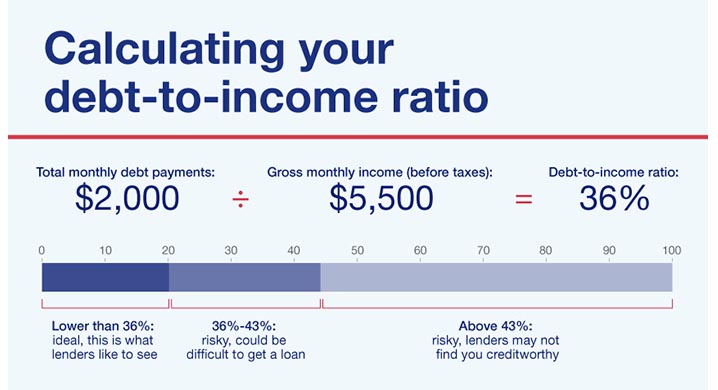

Lenders will add up all your outstanding debts and compare the total to your before-tax income. The result, known as your debt-to-income ratio (DTI), is a key indicator of your ability to repay them. The lower your DTI ratio, the better you look.

For example, if your home mortgage payments, car loan installments and typical monthly spending on current credit cards add up to less than 30 percent of your monthly income, that shows you’ve got the means to pay back what you borrow on top of other living expenses. If they add up to half of your monthly income or more, it could suggest you’d struggle to pay back another loan, and therefore be an unwise risk.

3. Capital

Along with your monthly income, lenders look at the value of the assets you own, like the amount of money you have in savings or retirement accounts, investments you have, your car and your home (if you own it).

These assets serve as back up resources to the income you earn from employment. Lenders want to know that, if you lose your job or are unable to repay the money you borrow, you have the option of selling assets as a means to raise funds.

The total value of your assets minus your debts equals your net worth, a number which lenders consider as they decide whether and how much to loan to you. If you don’t own a home or other high-value assets, your monthly earnings and DTI take on greater importance.

4. Collateral

For certain types of loans, called secured loans, you’ll need to identify specific property you own that you can pledge as collateral on the loan. For example, you might use a car as collateral on an auto loan, or your home’s value as collateral for a home equity loan.

The lender will assess the value of the collateral you have to offer and use that value to decide how much they can lend to you or how much credit they’re willing to offer you.

Essentially, you’re assuring the lender that if you don’t pay the loan on your own, the lender can sell your asset to get their money back.

5. Conditions

To create a complete picture of you credit worthiness and risk, lenders also look at external factors beyond your personal situation.

These include current economic conditions, the investing environment and market conditions that could have an impact on your finances and, as a result, make it less likely you’ll be able to pay back what you borrow.

Now that you know what lenders are looking for, make sure you’re prepared to deliver the information they need in a way that shows you’re a risk worth taking.

Here’s what you’ll need to make yourself look like an attractive borrower when you apply for credit:

Basic application information:

You will also need:

If you haven’t borrowed money before and don’t have a track record with credit, you’ll need to take some additional steps to make yourself credit worthy in the eyes of a lender.

When used strategically and wisely, credit can help you achieve your financial goals.

Read six tips to improve your credit and find more credit resources from U.S. Bank.

Related content