Save 20% on TurboTax®.

U.S. Bank clients can take advantage of special savings when they file with America’s #1 tax prep provider. Plus, bulk up on your tax knowledge with free how-to videos, insightful tips, tax calculators and more.

Expecting a refund? Kickstart your savings.

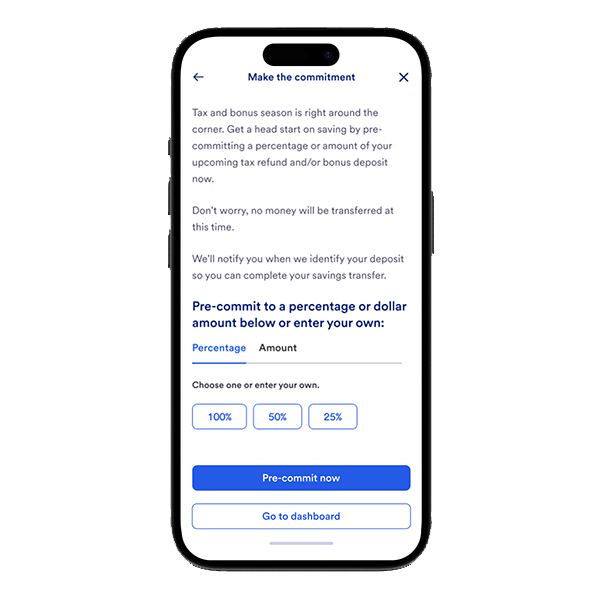

Pre-commit to save.

Research shows pre-committing can help some people save an average of 25% more.1 Our new digital tool makes it easy to pre-commit to save your refund or bonus. Just select how much you want to save, and we'll remind you when your deposit arrives.

Filing your taxes: The basics

You might have a few questions about filing before you get started. Here are a few things you should know:

- Jan. 31, 2025: W-2 and 1099 forms are mailed or delivered

- April 15, 2025: Individual tax returns are due. This is also the deadline for making an IRA or HSA contribution for the 2024 tax year.

- June 15, 2025: Individual tax returns are due for U.S. citizens living outside the United States or Puerto Rico.

- October 15, 2025: Individual tax returns for those who received an extension are due.

Outside of your personal information and identification, you'll need to make sure you have these documents on hand before filing:

- W-2 form which shows the amount of tax withheld from your paycheck

- 1099 forms if you've earned outside of what is listed on your W-2, such as earnings through:

- Interest income from a bank savings account

- Brokerage account earnings

- Selling of real estate, stock or other investments

- Unemployment

- 1098 forms if you've made interest payments, such as:

- Mortgage interest payments

- Tuition payments

- Student loan interest payments

- Form 5498 if you've made IRA contributions

- Form 1095-A to prove enrollment in health insurance coverage

Come tax time, some forms will be delivered to you while others you will need to track down yourself. Your W-2 and 1099 forms will be mailed or post-marked by January 31, 2024. For a full list of all tax documents and forms, visit the IRS forms and publications database, and visit USA.gov to learn more about how to obtain your tax forms.

If you are a U.S. Bank customer, you can view your mortgage-related tax documents online:

Online banking steps:

- Log in to your account.

- Select My Documents on the dashboard.

- Choose the type of document you want to view — statements, letters & notices or tax documents.

- To see older documents, select View more.

- Use the Search function to find your documents easily.

Mobile app steps:

- From the main menu, choose Statements & docs.

- Choose the type of document you want to view — statements, letters & notices or tax documents.

- Select the account for which you wish to review the documents.

- Use the Search function to find your documents easily.

If you do not have the funds available to pay what you owe in taxes, contacting the IRS and your state tax office is a great first step. Even if you can't pay the whole sum of what you owe, you should still file your taxes on time. Making a partial payment may help to reduce penalties and repayment plans are available.

There may be loan options available to you to assist in paying off tax debt, such as a home equity loan. To learn more about loan options, make an appointment to speak with a banker via phone, online or in person.

For some situations, you may be able to e-file your taxes for free with an IRS Free File partner. Learn more about IRS Free File.

Also, there are tax credits available for those who qualify. Credits like the Earned Income Tax Credit (EITC) are designed to help low- to moderate-income workers and families get a tax break.

Life events that might impact your taxes

Have you experienced one of these special situations in 2024? If so, there could be a change to the way you file your taxes. Find out more about what you’ll need to consider when it comes time to file your taxes this year.

- You got married.

- You welcomed a new child to your family.

- You got divorced.

- You bought or sold a home.

- You started a new job or got a promotion.

- You retired.

Financial perspectives

Plan ahead to get the most of your taxes all year long.

Read up on info to help you stay on track with a thoughtful approach to taxes and their impact on your long-term financial plan.

Featured articles

Top tax season tips to avoid stress and stay organized

Filing taxes doesn’t have to be stressful. Use these tax season tips and advice from our behavioral scientist to navigate filing with confidence.

What to do with your tax return or bonus

With a little smart planning, you can maximize the impact and make big progress toward your financial goals.

7 tax terms and concepts you should know

From withholding and filing status to deductions and deadlines, get up to speed in time for the next Tax Day.

Should I itemize my taxes?

Depending on your situation, you could save more by not itemizing and taking the standard deduction.

Freelancer’s tax guide: Simplify your filing process

Say goodbye to tax season stress. From estimated payments to business structures, learn the ins and outs of freelancer taxes in our comprehensive guide.

How to be prepared for tax season as a gig worker

If you have a side hustle or do gig work full-time, brush up on the basics so you’re prepared for tax season.

Get the latest tax-related news.

Tax and legislative updates

Current news from the IRS

TurboTax guide to filing taxes in 2025

1. Source: Journal of Economic Behavior & Organization, Volume 180, December 2020

As the leader in tax preparation, more federal returns are prepared with TurboTax than any other tax preparation provider. Limited time offer for TurboTax 2024. Discount applies to TurboTax federal products only. Actual prices are determined at the time of print or e-file and are subject to change without notice. Terms, conditions, features, availability, pricing, fees, service and support options subject to change without notice. Intuit, TurboTax and TurboTax Online, among others, are registered trademarks and/or service marks of Intuit Inc. in the United States and other countries.

U.S. Bank and its representatives do not provide tax or legal advice. Your tax and financial situation is unique. You should consult your tax and/or legal advisor for advice and information concerning your particular situation.