IRA vs. 401(k): What's the difference?

Start a Roth IRA for kids

One of the most popular—and useful—tools you can use for retirement savings is an individual retirement account (IRA).

Think of an IRA as a bucket that you can fill with stocks, bonds, mutual funds, exchange-traded funds (ETFs) and other investment vehicles.

The investments in your IRA bucket provide tax advantages that regular investments don’t offer. Even better, the money you invest in an IRA is compounded tax-free year over year, helping your nest egg grow over time.

Here are some common questions about how an IRA works and whether it could be a good option for you as you save for retirement.

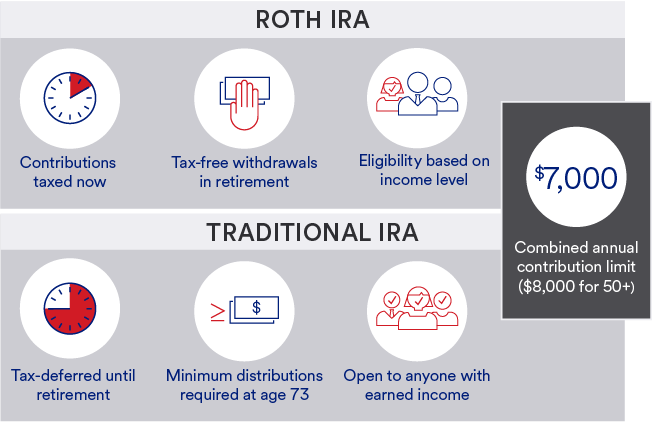

It depends on your goals. The biggest difference between traditional IRAs and Roth IRAs is how they’re taxed. There are also differences related to withdrawals and required distributions.

Learn more about different types of IRA accounts.

You can open either a Roth or traditional IRA by the tax filing deadline of the previous year. If you open a traditional IRA, you may be able to deduct your contribution and reduce your taxable income for that tax year.*

The amount of money that you contribute to an IRA before the tax deadline counts toward the prior year’s limit ($7,000 for tax years 2024/2025). For example, if you open a new IRA in January, you could jumpstart your investment by contributing $7,000 before the tax deadline and then another $7,000 (or whatever the current limit) before the tax deadline of the following year.

Many people have both an IRA and a 401(k), because they both will help toward their retirement goals. Here’s a look at the requirements and benefits of each.

|

|

IRA |

401(k) |

|---|---|---|

|

Maximum annual contribution |

$7,000/year ($8,000 if age 50+) |

$23,500/year (plus additional contributions if age 50+) |

|

Setup |

You set it up yourself through your bank or an investment broker, like U.S. Bancorp Investments. An IRA is also a common option for those whose employers don’t offer a 401(k) (such as those who are self-employed, own their own business or are part of the gig economy). |

A 401(k) is usually part of an employer’s benefits package, where they have an agreement with an investment broker to offer investments. |

|

Investment options |

You can choose any mix of investments to include in your IRA. You can make these decisions yourself or use a guided investment solution to fill your bucket. |

An employer-sponsored 401(k) plan usually has limited investment options, and many times your portfolio is added to a general target-date fund (the year you’re aiming to retire). |

Maximum annual contribution

IRA

$7,000/year ($8,000 if age 50+)

401(k)

$23,500/year (plus additional contributions if age 50+)

Setup

IRA

You set it up yourself through your bank or an investment broker, like U.S. Bancorp Investments. An IRA is also a common option for those whose employers don’t offer a 401(k) (such as those who are self-employed, own their own business or are part of the gig economy).

401(k)

A 401(k) is usually part of an employer’s benefits package, where they have an agreement with an investment broker to offer investments.

Investment options

IRA

You can choose any mix of investments to include in your IRA. You can make these decisions yourself or use a guided investment solution to fill your bucket.

401(k)

An employer-sponsored 401(k) plan usually has limited investment options, and many times your portfolio is added to a general target-date fund (the year you’re aiming to retire).

|

|

Automated investing |

Self-directed investing |

Financial professional |

|---|---|---|---|

|

|

Offered exclusively by U.S. Bancorp Investments |

Offered exclusively by U.S. Bancorp Investments |

|

|

Who manages it? |

Robo-advisor |

You |

A financial professional |

|

Effort |

Low |

High |

Varies |

|

How does it work? |

The robo-advisor builds an online investment portfolio for you based on your goals and preferences. It monitors and adjusts your account as the market fluctuates. |

Gives you complete freedom if you’re an experienced and hands-on investor. You can buy and sell specific investments online. |

You’ll work with a professional to create a financial plan that is aligned with you retirement goals. |

|

Works well if… |

you are starting out and want a diversified mix of investments selected and managed for you. |

you are confident in making your own investment decisions. |

you have more sophisticated or complex financial needs or prefer personal guidance. |

|

More information |

Automated investing

Offered exclusively by U.S. Bancorp Investments

Self-directed investing

Offered exclusively by U.S. Bancorp Investments

Financial professional

Who manages it?

Automated investing

Robo-advisor

Self-directed investing

You

Financial professional

A financial professional

Effort

Automated investing

Low

Self-directed investing

High

Financial professional

Varies

How does it work?

Automated investing

The robo-advisor builds an online investment portfolio for you based on your goals and preferences. It monitors and adjusts your account as the market fluctuates.

Self-directed investing

Gives you complete freedom if you’re an experienced and hands-on investor. You can buy and sell specific investments online.

Financial professional

You’ll work with a professional to create a financial plan that is aligned with you retirement goals.

Works well if…

Automated investing

you are starting out and want a diversified mix of investments selected and managed for you.

Self-directed investing

you are confident in making your own investment decisions.

Financial professional

you have more sophisticated or complex financial needs or prefer personal guidance.

More information

Automated investing

Self-directed investing

Financial professional

Related content

*Your deduction may be reduced or eliminated based on income.