How much money do I need to start investing?

Investment strategies by age

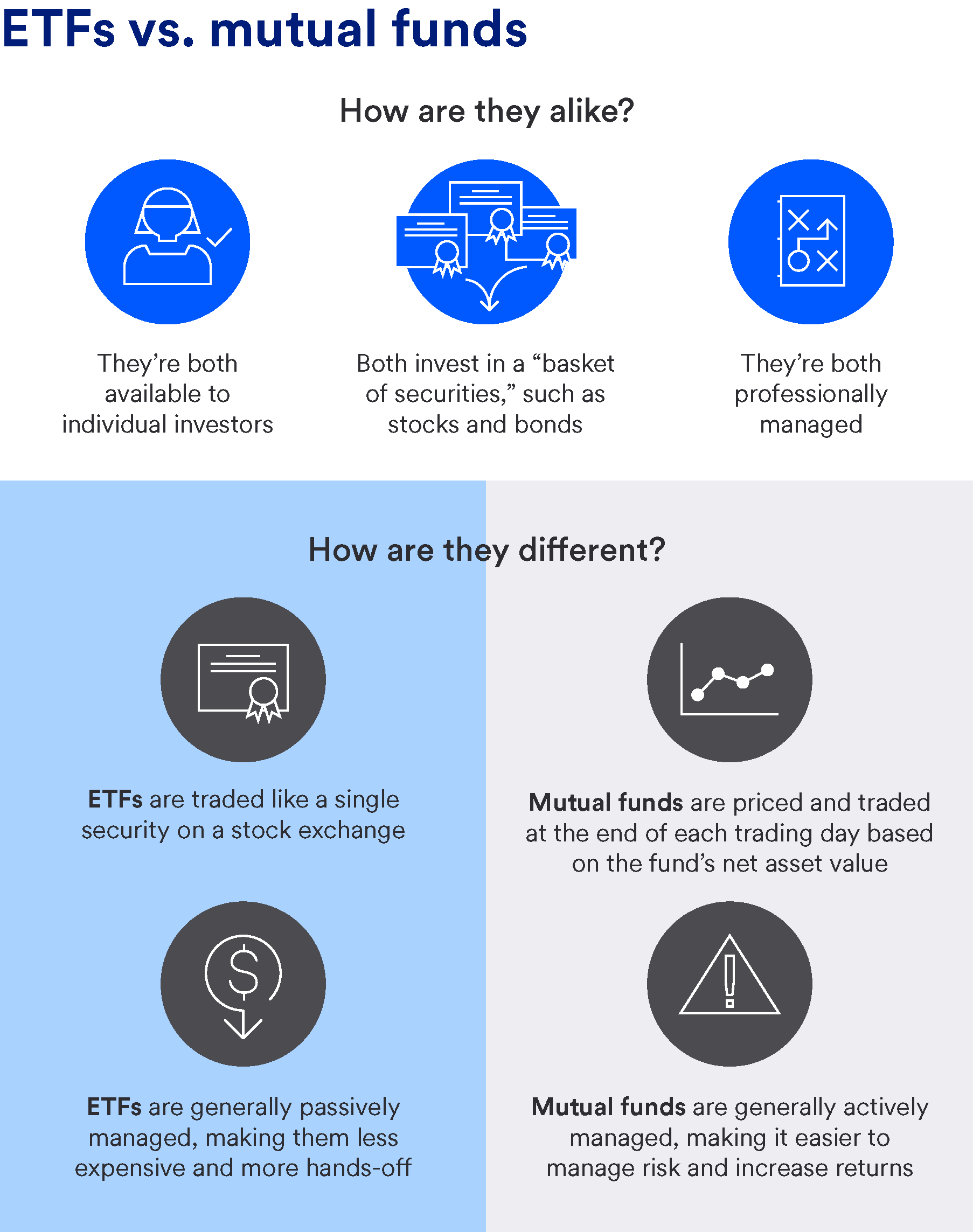

Mutual funds and exchange traded funds (ETFs) are two types of investments available to individual investors. While similar, there are important differences between them that you should understand as you build your investment portfolio.

According to Lisa Erickson, senior vice president and head of public markets due diligence for U.S. Bank, both mutual funds and ETFs invest in what’s typically referred to as “a basket of securities,” comprised of stocks and bonds.

“Mutual funds and ETFs are designed to meet specific objectives by investing in certain types of securities, such as U.S. stocks or the stocks of companies located in certain regions of the world,” she says.

Another similarity is that both mutual funds and ETFs come with professional management. This means investors don’t have to try to build their own portfolio of securities that will meet their risk and return objectives—a tricky proposition given how many different types of securities there are to choose from.

Purchasing a mutual fund or ETF gives investors diversified exposure to a particular segment of the market without having to buy and sell hundreds of different securities themselves.

The differences between ETFs and mutual funds start with how they’re constructed and traded. Even though they contain a basket of securities, ETFs are traded like a single security on a major U.S. stock exchange. ETFs can be bought and sold intra-day, just like any security.

In contrast, mutual funds are priced and traded at the end of each trading day based on the fund’s net asset value (NAV). “This means there’s less flexibility with regard to timing and price with mutual funds,” says Erickson. “ETFs give you more control over when to enter the market and at what price. On the flip side, you may need to pay a trading commission when you invest in an ETF, something that usually doesn’t apply to mutual funds.”

Also, most ETFs are passively managed. In other words, they’re designed to automatically track a market index, like the S&P 500. Most mutual funds, on the other hand, are actively managed, with the goal of outperforming a market index. As a result, ETFs are usually less expensive and more tax efficient than mutual funds since there is less turnover in securities and lower trading costs. It also means, however, that ETFs forgo the opportunity to manage risk or return relative to the bench they track..

The expense ratios for ETFs tend to be lower than mutual funds due to their passive management. In 2021, the average expense ratio for actively managed funds was 0.60%, compared with 0.12% for passively managed funds, according to the Morningstar 2021 U.S. Fund Fee Study.

Erickson notes that with their active trading, mutual funds tend to generate more capital gains than ETFs, which has tax implications for investors. “When securities in a mutual fund are sold at a gain, the gain is passed on to shareholders, who must pay capital gains tax even if they don’t sell their mutual fund shares,” she explains. For this reason, mutual funds may often held in tax-advantaged accounts like IRAs and 401(k)s, while ETFs are often held in taxable accounts, such as brokerage accounts.

So, which type of investment is the right choice for you? It depends on your investing goals and objectives.

Mutual funds are often a better choice for individuals who want to automatically invest a set amount of money at certain intervals, such as monthly. This strategy, commonly known as dollar-cost averaging, is often used to build wealth over a long period of time to meet long-term objectives like saving for retirement.

Mutual funds also tend to be a good choice for investors who want to not just track but attempt to beat the returns of market indices. “Mutual funds offer the opportunity to manage risk and increase returns,” says Erickson.

Meanwhile, ETFs may be a good choice for individuals who want to minimize investing costs and capital gains taxes. ETFs provide more straightforward exposure to a market for investors who are cost-conscious and less concerned about picking and choosing individual securities. They’re a cost-efficient way to get broad market exposure and diversify your portfolio.

If you want to perform your own research and construct an investment portfolio yourself, you can purchase ETFs and mutual funds directly from the investment companies that market and sell them. Or you can work with a financial professional to build a customized portfolio.

“There are so many options when it comes to choosing ETFs and mutual funds that it can be overwhelming for some people,” says Erickson. “A financial professional can help you narrow down the options and choose the right funds based on your investing goals, risk tolerance and time horizon.”

Frequently asked questions about ETFs and mutual funds

Q. Why buy an ETF instead of a mutual fund?

A. ETFs may be a good option for you if you’re looking to minimize investing costs and capital gains taxes. They’re a cost efficient way to diversify your portfolio and get broad market exposure.

Q. How do ETFs differ from mutual funds?

A. ETFs and mutual funds differ in how they’re traded and managed.

ETFs are:

Traded like a single security on a stock exchange

Generally passively managed, making them more hands off and less expensive.

Mutual funds are:

Priced and traded at the end of each trading day based on the fund’s net asset value

Generally actively managed, making it easier to manage risk and increase returns

Q. Are ETFs more tax-efficient than mutual funds?

A. Because ETFs are passively managed and designed to automatically track a market index, they’re usually more tax efficient than mutual funds since there’s less turnover in securities and lower trading costs.

Take this quiz, offered by U.S. Bancorp Investments, to find an investing style that fits your needs.

Related content