How Everyday Funding can improve cash flow

How real-time inventory visibility can boost retail margins

By Don Russel, U.S. Bank, Regional Business Director Mass Transit

In the past two years, consumer use of contactless payments has surged. People love the simplicity and safety of paying for coffee, groceries, gas, and more by tapping a card, phone, or wearable. Visa reports1 that nearly one out of every 10 Visa card transactions made at the point-of-sale (POS) in the U.S. is with a contactless card. Digital wallet use is skyrocketing as well, with forecasters estimating that 4.4 billion global consumers will shop with a digital wallet by 2023, accounting for 52% of e-commerce payments globally.2

As public transit use returns to pre-pandemic levels, transit agencies are looking for ways to give riders better, more flexible travel experiences. Switching to contactless payment systems that let riders use their credit card, debit card, or mobile wallet to tap to pay tops the list of popular strategies. Visa reports there are currently more than 700 U.S. transit projects underway that include the introduction of contactless tap-and-go payment methods. And according to Juniper Research3, contactless payments will triple to $6 trillion worldwide by 2024. In the U.S. market, contactless transaction totals are expected to rise even faster, reaching $1.5 trillion by 2024, compared with about $178 billion in 2020.4

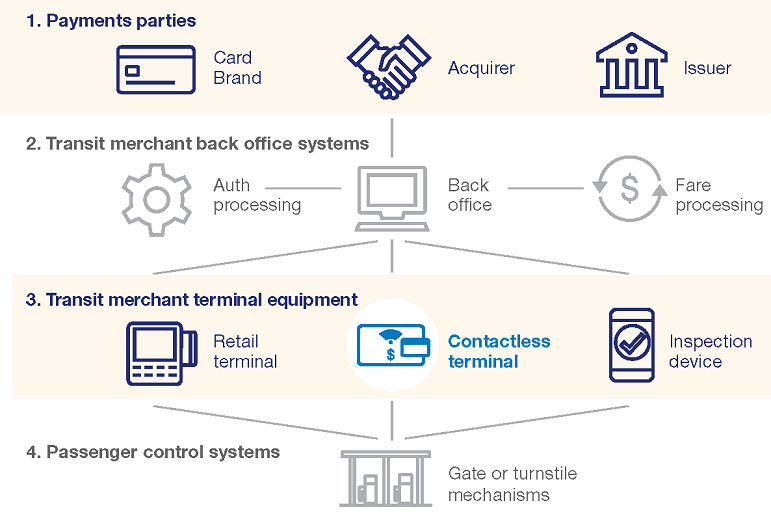

Contactless payments work the same way chip cards do, by sending a secure, unique one-time token to the payment terminal. A rider taps to pay and the transit agency’s mobile payment device, card reader or terminal processes the payment. The entire transaction takes about two seconds.

Here’s a snapshot of the entities involved in a contactless payment transaction:

No matter where they live, mass transit users have one thing in common—they see contactless options as a way to reduce the frustration and hassles of outdated payment systems. In Visa’s 2022 Future of Urban Mobility survey,5 respondents listed these as the top benefits of contactless payments:

Nearly a third of respondents (32%) said that offering contactless payments is one of the top features that would encourage them to ride public transit at all.

Switching to contactless saves time, money, and hassle for riders by:

And contactless helps agencies deliver cost-effective, better experiences by:

Interested in learning more about how tap-to-ride contactless solutions can help optimize costs while offering passengers a better experience? Download our ebook or contact us to discuss creating a contactless fare collection experience.

Related content

References:*

1. https://navigate.visa.com/na/spending-insights/tapping-into-the-future-of-payments/

2. Pymnts.com, March 2021. Mastering Multichannel Commerce.

3. https://www.paymentsdive.com/ex/mpt/news/contactless-payments-tripling-by-2024/

4. https://www.paymentsdive.com/ex/mpt/news/contactless-payments-tripling-by-2024/

5. https://usa.visa.com/content/dam/VCOM/blogs/visa-future-of-urban-mobility-one-pager.pdf