How Everyday Funding can improve cash flow

Digital trends poised to reshape hotel payments

In today’s complex healthcare environment, patients have become active healthcare consumers evaluating treatment options and weighing the costs. More than ever, patients expect the same cost transparency, and payment ease and flexibility they enjoy in other areas of their lives. Through adoption of digital technologies and process automation, healthcare organizations can transform payments to meet patient expectations.

The payments transformation landscape is evolving. During the recent HealthLeaders Revenue Cycle NOW Summit, Misty Grambow, Vice President of Healthcare and Non-Profit Solutions at U.S. Bank/Elavon, noted that payments transformation isn’t just about payments, patient experience, or security. It’s about how combining those elements can create the optimal patient experience while meeting provider needs.

Investing in payments transformation helps drive success for providers and patients by improving the patient financial experience, expediting accounts receivables, and boosting staff efficiency. In a recent survey with FT Longitude, 60 finance, treasury, and revenue management executives at US healthcare organizations shared insights about what payments transformation means for their patients and organizations. Here’s what we learned:

Align with a banking partner that 'gets' healthcare.

From payers to providers and manufacturers, our healthcare industry experts understand the nuances of your business. We're here by your side to help your financial operations run smoothly. Entrust us to support your financial, operational and investment goals with a holistic consultative approach.

The consensus is clear. Fifty-nine percent of financial leaders across several sectors, including healthcare, agree that without transforming their current payment acceptance capabilities, they can’t improve consumer experience.

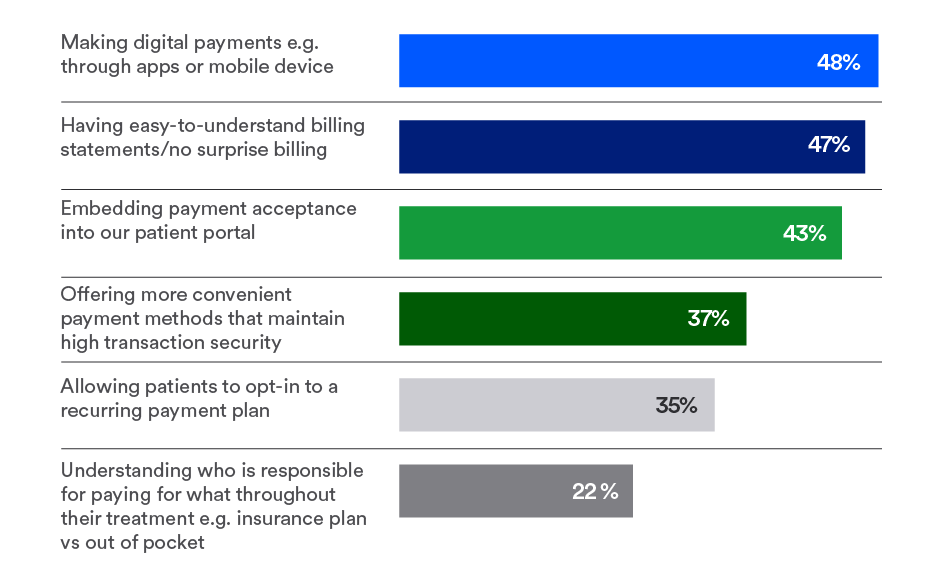

Top payment priorities for healthcare consumers according to our survey:

Successful digital engagement strategies also mean offering flexible payment options, including recurring payments, that make it easier for patients to cover high out-of-pocket costs. Our survey participants recognize that consumers want choices that make it easier to understand what they owe and less stressful to pay higher balances.

According to Misty Grambow, payments transformation creates a more positive financial experience by helping patients access their complete financial picture, pay bills more quickly, and get timely help clarifying the billing and payment process. The benefits of investing in payment transformation are real. Simplifying the patient billing processes increases the likelihood of timely payments and improves the overall patient experience.

Learn more about how we can help you transform payments to achieve business goals and create a better patient experience

Related content