How Everyday Funding can improve cash flow

How real-time inventory visibility can boost retail margins

By Joe Myers, President of North America at U.S. Bank Payment Solutions/Elavon Inc.

U.S. Bank is here to help simplify your financial life. The impact of COVID-19 created an opportunity to maintain your operations in an increasingly remote world. Here are solutions you can implement as you and your employees adapt to what's ahead.

U.S. Bank is here to help simplify your financial life. The impact of COVID-19 created an opportunity to maintain your operations in an increasingly remote world. Here are solutions you can implement as you and your employees adapt to what's ahead.

COVID-19 accelerated the adoption of digital technologies and spurred innovation in new care models and patient experiences that put an emphasis on safety and convenience, such as telehealth and remote clinical monitoring. The pandemic also exposed weaknesses in business practices ranging from patient communications to billing methods that left patients and family members confused and frustrated.

The pandemic transformed the ways that consumers pay, influenced by the rapid adoption of digital and contactless payment methods in segments from retail, to grocery, restaurant, and service industries. As a result, patients now expect similar innovations in how they pay for healthcare and are increasingly demanding better experiences tailored to their unique needs.

Healthcare providers in tune with this shift are placing a renewed focus on patient engagement, adopting practices centered on improving the connection between a patient’s physical and financial health. Success extends beyond implementing the latest technology. It requires a deeper understanding of the people behind the payments: patients, families, and healthcare staff.

As witnessed in the results of our 2021 Healthcare Payments Insight Report, when chosen wisely, technology helps everyone work better together to provide the most convenient and suitable payment options that meet patient needs and expectations. Simply put, people-centered payments enhance the patient experience, simplify billing practices, and improve revenue cycles.

Many innovations adopted in response to pandemic-related safety guidelines or patient concerns proved wildly popular. Venture investors pumped over $30 billion into digital health start-ups since the beginning of 2020, with an emphasis in telemedicine and other technologies that make medical systems more effective.

The popularity for telehealth bore out in our study. In our 2019 survey, 66% of Americans were interested in video or phone consultations, yet only 10% reported receiving a telehealth appointment. The pandemic accelerated the adoption, and two-thirds of this year’s respondents said they had at least one telehealth consultation in 2020. A full 69% told us they want telehealth to remain an option going forward.

Notably, of the 65% who had a telehealth appointment in 2020, 45% told us they received their bill via postal mail. This is a missed opportunity to continue the digital-first experience that patients – especially Millennials and GenZ – crave.

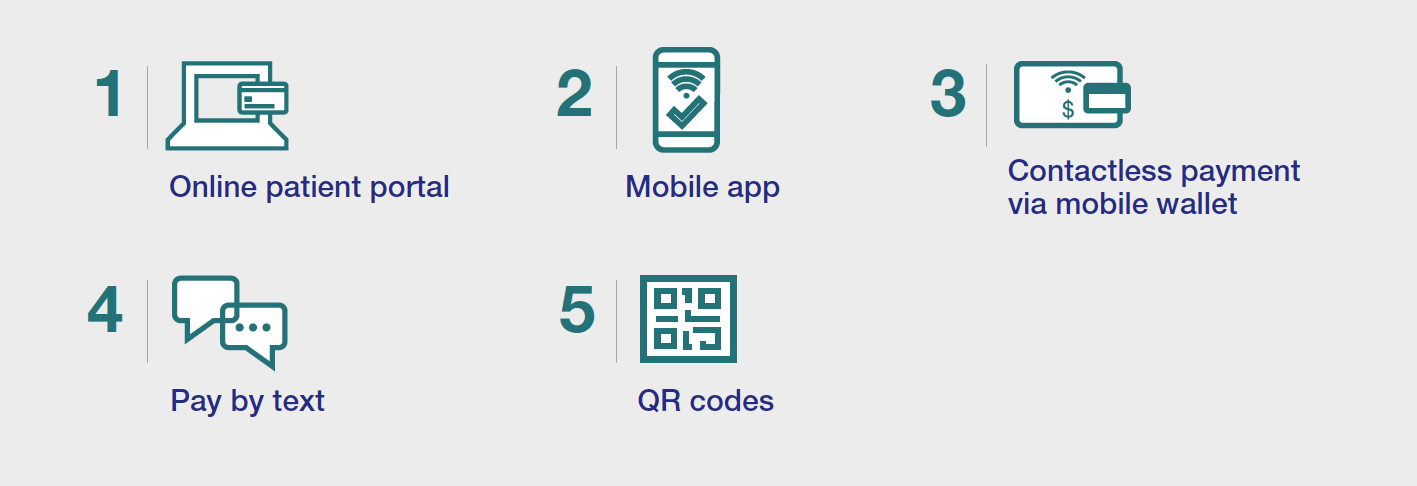

Healthcare lags other consumer-oriented industries, and it can impact patient’s decisions when choosing a provider. Nearly half (46%) of consumers rated healthcare as the most difficult industry when it comes to making payments. People wish healthcare were more like the banking industry, where they easily log into a portal or mobile app to check balances, make deposits, transfer money, and pay bills.

When providers know and understand what people need, they are better prepared to tackle the system upgrades and integrations necessary to deliver a better patient experience. There are many opportunities for improvements surrounding digital payments, billing communications and online security.

Providers must embrace digital innovations, or risk losing their patients to technology-forward competitors. CXOs and CMOs should take note. Since payment is often the final step in the experience, patients who get frustrated when paying a medical bill will often leave a negative review, even if they were satisfied with the clinical care. In today’s competitive healthcare environment, providers can’t risk their reputation by being perceived as technologically behind.

Thoughtful investment in updating revenue cycle and payment workflows can yield positive results for providers and patients. In addition to an improved patient experience that builds loyalty, providers gain efficiencies that yield financial rewards.

Consider the following insights related to revenue collection as you prioritize investments to modernize the patient financial experience:

Productivity also rises with the integration of payments. When payments are connected to appointment booking and electronic health records (EHR) systems, staff spends less time reconciling various platforms and entering information manually. This reduces errors and frees them to focus on tasks that directly improve the patient experience.

Successful consumer financial engagement is crucial to delivering a positive patient experience. Meet them with people-centered payment solutions for the new normal.

As Chief Revenue Officer and President of Elavon North America, Joe Myers leads over 1,000 sales, marketing, digital strategy, and customer account management professionals focusing on building loyalty in our existing customer base, seeking key referral relationships, and driving overall new business development. He has held high-profile leadership positions in the payments industry for over 20 years, and is instrumental in the overall U.S. Bank payment solutions growth strategy.

To learn more about how the pandemic is transforming healthcare payments and patient expectations, check out the full results from our survey in our 2021 Healthcare Payments Insight Report.

Related content