Digital trends poised to reshape hotel payments

3 ways to make practical use of real-time payments

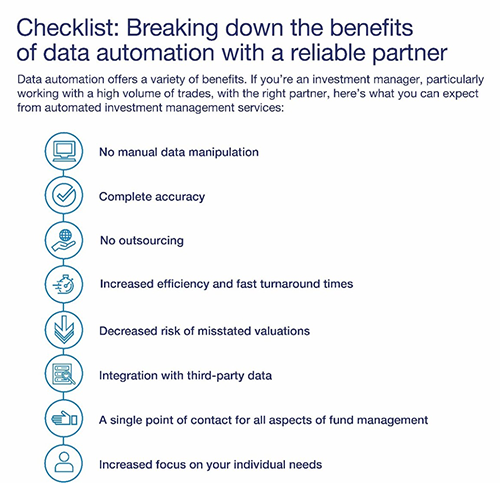

Over the past several years, data automation has become central to reducing risk, ensuring accuracy and, ultimately, empowering investment managers to deliver a faster higher quality client service supported by granular investor reporting.

To remain competitive and to meet the evolving needs of investors, the focus of the investment manager has shifted significantly to include effective data management in areas beyond their primary responsibility of portfolio selection.

Here, we’ll review the latest trends in data automation and consider how automation can particularly benefit firms that trade in high volumes or with diverse portfolios.

Across financial services, and particularly within banking, major firms are pushing next generation data automation into their processes. The benefits are wide reaching, and ultimately are becoming central not just to efficient operations but to effective client service.

First, automation is the central tenet of sound practice within data management. When your data is automated, it’s cleaner and less likely to be compromised by human error. Data that’s handled by multiple, often third-party systems, carries the additional risk of corruption or production interruption. As all investment managers know, mistakes in any of these areas can be costly.

“A data error generally goes hand in hand with reputational risk to the fund, which in every sense is bad for business,” says Ken Somerville, chief operating officer for U.S. Bank Global Fund Services Europe.

On the flip side, data automation increases efficiency and decreases turnaround time. “Automation has enabled us to redirect resources to higher value client service areas thereby broadening our offering,” says Conor Burns, head of fund accounting for U.S. Bank Global Fund Services Europe. Ultimately, this allows fund managers to spend more time focusing on clients’ individual needs and investment goals.

To get a better sense of how effective data automation can make your job easier as an investment manager, it’s helpful to understand the role automation plays in specific fund administration processes.

Straight-through processing, systematic master creation and fund-family reconciliation all facilitate successful services to high-volume trading funds supported by our teams in U.S. Bank. Somerville notes that in a typical month, the Global Fund Services team processed more than 1.5 million trades captured from 13 client systems via almost 400 file transfers.

When searching for an investment services partner to support your high-volume trading funds, it’s important to consider not only the automation processes that are currently implemented, but also how that partner approaches continuous improvement. Excelling in data automation requires a commitment to investing in automation technology, incorporating client feedback, and thereby continually improving processes.

“Excelling in data automation requires a commitment to investing in automation technology, incorporating client feedback and thereby continually improving processes.”

“The timeliness of our reporting and the accuracy of our output is obvious to our clients, and this doesn’t happen by accident,” Somerville says. “It happens because we’re continuously improving our data management. We continued to grow a central depository for all of our data, (our in-house implementation of a data lake) to receive, store and feed all fund services data via a single reporting portal, Pivot.”

All that said, data automation on its own will only get you so far. The unique features of investment funds, in essence the alpha that distinguishes management companies from each other means that the personal touch still counts. It’s important to find a fund services partner that combines advanced data automation with a client centric focus.

“We simply don’t consider all data to be the same,” Somerville explains. “Strategically, we consider all of the ways in which we receive, process and report our information to discern whether it can be handled most effectively, either centrally with our technology unit or in an individually with our operations team.”

An individualised approach delivers investment managers an automation solution tailored to their unique needs. “Internally, we allocate the right kind of talent to the specific challenge that each client represents,” Somerville says.

A strong fund services partner also considers client feedback to continually improve data automation processes. “It’s important to constantly look at ourselves and see what we can improve on. That’s key to everything we do,” Burns says.

For example, each of our operations team keeps a regular inventory of its manual processes and then grades each process on the level of risk of error and on the number of resources used, Burns explains. “From there, the operations leaders and the tech team collaborate to decide which processes should be automated.”

“This continuous improvement manifests itself in everything we do,” Somerville says. “It’s a living, breathing exercise for us. This is an area where we really distinguish ourselves and outperform our peers.”

As you examine the automation processes of a fund services partner, ensure they’re committed to taking a client-centric approach. “We strive to help the client with their own systems,” Burns explains. “If, for example, a client also uses a provider that processes data for risk reporting, foreign exchange hedging, or simply to give them their data sooner, we work with our client to assist with that relationship.”

Today we can provide straight-through processing into any third-party service providers that an investment manager works with. “If our clients can receive that from us without adding a touchpoint with the third-party provider, then we’re helping them reduce their costs on other services as well,” Burns says.

Having a single point of contact offers other benefits, too. With U.S. Bank, investment managers don’t need to worry about working across time zones or with multiple people. “By removing data-management tasks from employees, our employees get a broad view of a client’s needs and they’re able to answer a wider range of client queries,” Burns says.

At the end of the day, data automation is not merely a technological issue. “Being a good data manager means being a good service provider,” Somerville explains.

At U.S. Bank, we leverage data automation and innovative technology to help you achieve your business goals. To learn more about our comprehensive fund administrative services, visit usbank.com/globalfundservices.