How Everyday Funding can improve cash flow

How real-time inventory visibility can boost retail margins

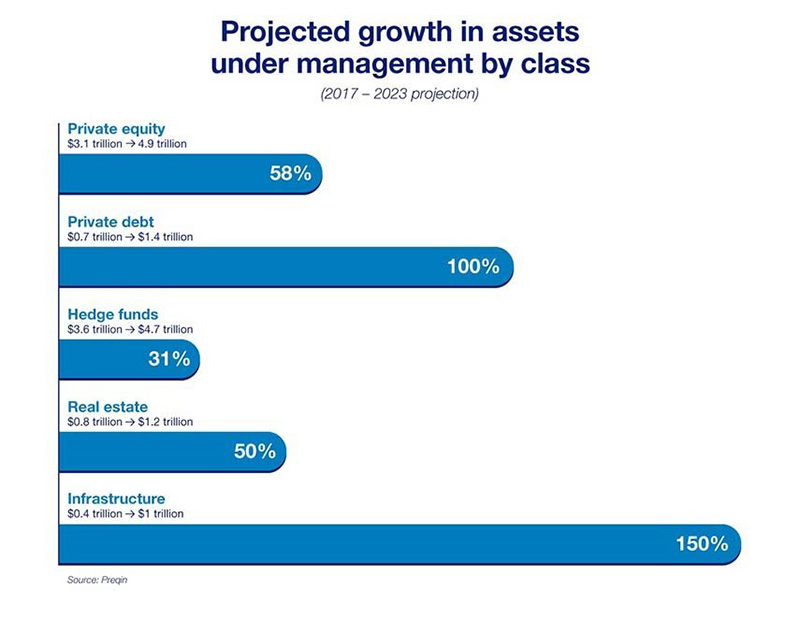

Alternative investments have already made significant inroads among institutional and high net worth investors, and they’re set to continue growing over the coming years.

By 2023, Preqin anticipates the market value of alternative investments will reach $14 trillion – a 59% rise over 2017 levels – with 34,000 managers around the world running alternative investment funds.

Along with the opportunity for increased returns, this might also mean increased legwork for your organization.

Alternative investments – such as hedge funds, private equity (PE), real assets, commodities, natural resources and derivatives – are valued for their limited correlation to traditional stock and bond market performance. Admittedly, risks can run higher as alternative investments are generally less regulated, illiquid and tend to use more leverage than traditional investments. In turn, however, the returns can bolster the performance of a well-diversified portfolio.

“Learning to track and report on alternative investments can help ensure you’re meeting your goals.”

“There’s such a wide spectrum of alternative investments at this point that clients can choose what’s appropriate for them, based on what type of entity they are, their risk tolerance and what they’re trying to accomplish with their investment plan,” said Ryan Bollinger, CAIA, vice president in Institutional Trust and Custody at U.S. Bank.

One of the most perplexing characteristics of an alternative investment is its current value. For example, unlike a mutual fund that holds a collection of publicly traded securities with readily available market capitalizations, a PE fund could hold stakes in dozens of closely held companies that have minimal reporting requirements.

“A lot of underlying investments in PE funds are extremely illiquid and therefore hard to value, especially on a quarterly basis,” Bollinger said. “Additionally, many times they’re on a significant lag, so a September report may be reflecting information from as long ago as March. So you can see where the accounting doesn’t necessarily fit like a mutual fund or even some derivatives.”

Aside from the asset valuations, cash flow activity such as capital calls or distributions, which may occur on a monthly, quarterly or sporadic basis, can result in significant swings in value, Bollinger adds.

To manage the data and information, some investors still rely on legacy spreadsheets or modified internal accounting systems. The capacity for such solutions, however, to scale up and handle greater volumes of data, as well as heightened demands to track performance, could fall short.

Such system requirements will likely only steepen going forward, as Preqin expects that “automation and data-powered decision-making” will become the norm for sophisticated investors.

As the landscape shifts and alternative investments play a larger role in your investment strategy, your expectations will likely change course as well. Fund values based on stale data and cash flow models that don’t reflect real-time information can be inefficient and disrupt planning.

Considering the growing burden on your systems, third-party administrators can help alleviate the challenges. With investment tracking and reporting streamlined through an outside party, your internal resources can recommit to analysis and decision-making. Furthermore, the outside records can serve as a valuable check on internal accounting efforts.

Although third parties can ease the mundane hassles of portfolio management, some time-consuming processes may linger. For example, some custodians require a letter of direction for every transaction, which can become cumbersome for a holding that requires monthly moves or a portfolio with a number of such funds.

Given its extensive experience in working with institutional and high net worth investors, U.S. Bank takes a different approach. It views such relationships as partnerships designed to resolve back-office woes and free the client to focus on the best investment options in today’s marketplace.

Specifically, U.S. Bank offers a calculation that rolls forward from the current value date, providing a timely snapshot of all alternative investments by:

This core service may be tailored to each client’s unique situation, which may include:

“When you’re investing in alternative investments, you must contend with various information asymmetries between the actual manager reports and other information,” Bollinger said. “We understand that different clients have different needs, so we offer levels of flexibility to provide somewhat customized reporting if it’s appropriate and we’re able to support it.”

Should your investment team determine their time is better spent analyzing and sharing performance rather than collecting and distilling results, visit usbank.com/custody or contact us to learn more about your alternative investment solution options.

Related content