How Everyday Funding can improve cash flow

5 tips for parents opening a bank account for kids

Money movement is notoriously complex. Corporate treasury departments spend an incredible amount of time organizing demand deposit accounts (DDAs) and their associated transactions to manage cash flow, reporting and reconciliation — as well as for any number of operational and strategic reasons.

Not only can it be cumbersome to manage numerous physical DDAs, but paying related transaction fees can also be expensive.

For many organizations today saddled with tens or even hundreds of DDAs, there is now a more efficient way to operate.

Virtual account management (VAM) offers a way to manage accounts digitally within a single physical account, which provides a variety of benefits.

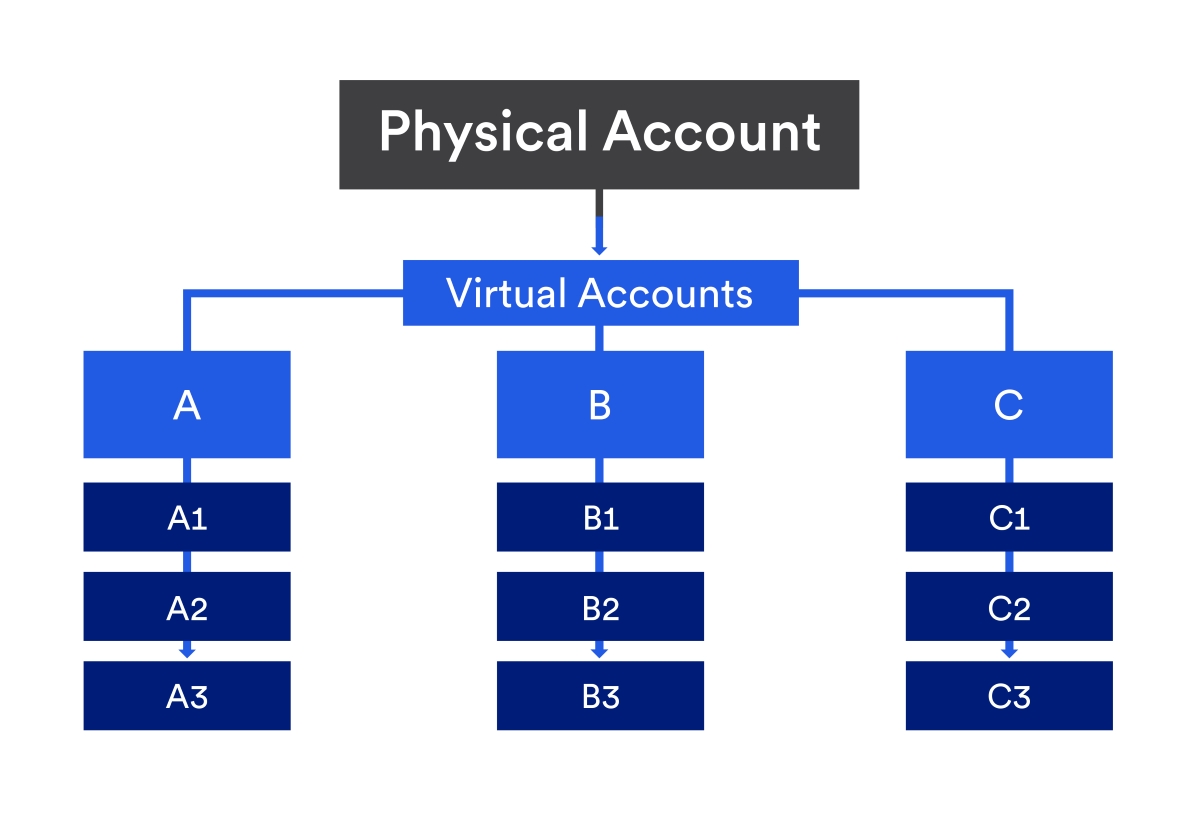

If an organization maintains multiple physical bank accounts, opening and closing those accounts, as well as adding and deleting services from each account, is complex and time-consuming. Plus, you are paying a fee for each account. With VAM, you can maintain one traditional DDA and build multi-level account hierarchies with virtual accounts.

“VAM gives you the flexibility to segregate balances and/or transactions to align with your organization’s business needs,” explains Larry Andretich, a senior product manager at U.S. Bank.

Virtual account management uses unique identifiers to allocate transactions to virtual accounts within a physical account. An incoming or outgoing payment simultaneously posts to the master physical account and to the relevant virtual account.

All your monetary transactions settle within the traditional DDA. However, you can designate certain transactions to be copied or replicated in appropriate virtual accounts.

Each individual virtual account provides the same segregation of data, balance analysis and transaction identification that a physical account would.

You can associate any number of virtual accounts to your physical bank account, assigning a purpose for each virtual account. This allows you to create and operate virtual account structures that mirror your organizational set-up.

Virtual account management produces an array of benefits:

▪ More effective liquidity management. Virtual accounts allow an organization to centralize cash without using complex sweeping structures. This supports better funds availability, optimized account balances and enhanced cash forecasting.

▪ Less administrative effort. Using VAM, you no longer need to maintain multiple DDAs to manage business lines and legal entities. This saves time on bank account administration. For example, opening a traditional account can take several weeks, while opening a virtual account can often be accomplished in minutes.

VAM also simplifies adoption of faster digital payment alternatives like Zelle® and instant payments. Once you establish these payment services on your traditional DDA, they are inherited by your virtual accounts.

▪ Reduced banking fees. Bank charges associated with maintaining and transacting with virtual accounts are much lower than for physical accounts. Thus, there can be significant savings in going from maintaining many traditional accounts to a structure where you only have one or a few traditional accounts and many virtual accounts.

▪ Flexible configuration and reporting. With VAM, you can report cash flow for each entity as needed without the restrictions associated with physical accounts. This puts you in control of how you view balances and transactions. For instance, you can track and report cash by customer, product, business unit, location or purpose. You can also reconfigure account hierarchies to keep pace with the changing needs of your business.

▪ More efficient receipts reconciliation. Let’s say you set up a different virtual account for each customer. Customer-specific virtual account numbers reduce the time and cost spent in receivables matching when there is missing remitter information on incoming receipts. Automatic remitter identification, which VAM enables, allows direct cash application in the accounts receivable system.

What types of businesses can employ VAM to achieve these benefits?

“There is not one single industry or business, size, scale, vertical or segment that can’t immediately benefit from virtual accounts,” says Vanessa Angeles, senior vice president and head of treasury management new product development at U.S. Bank.

VAM can typically benefit any organization that holds 10 or more DDAs.

For some, using VAM is an easy decision. Retail businesses with multiple locations are a prime example. “Each location has cash flow, mostly inflows for sales, and the retailer wants to track those flows by location,” explains David Bearl, group product manager for emerging liquidity solutions at U.S. Bank.

“The retailer could use real DDA accounts to do that, but it would be much less expensive and more effective to use virtual accounts to track those cash flows.”

VAM can also be attractive to many commercial real estate businesses, particularly ones that manage many properties and need to open and close accounts for those properties on a regular basis. VAM allows them to maintain a single physical account and designate virtual accounts for each property, which eases account administration. Also helpful to property managers: With some VAM offerings, each virtual account can be designated as having a different owner.

Similarly, it’s easy to understand how VAM might benefit a charitable non-profit that wishes to segregate donor funds by specific use, or a law firm that regularly opens trust and escrow accounts for its clients.

Treasurers can build virtual account structures with as many levels as they want.

Establishing a hierarchical bank account structure using virtual accounts is a natural for higher education. A statewide university system, for instance, could maintain a single physical DDA with virtual accounts that segregate cash flows for each of its 20 campuses. A third level in the hierarchy could include accounts for each college within each campus, such as the business, journalism and engineering colleges.

Moreover, the university’s treasurer might want the athletic department at each campus to have virtual accounts for each of its student sports, such as football, basketball and lacrosse.

The pace of business continues to accelerate. In this environment, you need to be able to open and manage bank accounts in minutes rather than weeks, and you need precise cash reporting.

VAM allows you to conveniently open and close accounts in a self-service mode while giving you the ability to review your consolidated cash position in real time. It’s a flexible tool that can benefit organizations across industries, enabling them to create account structures as layered as their businesses are.

“The possibilities presented by virtual account management are only limited by a treasurer’s imagination,” Bearl says.

For more information about innovations in treasury management and the benefits of digital-first payment solutions, and how faster payments and virtual accounts can accelerate your strategy, enhance liquidity and reduce risk, connect with a U.S. Bank Relationship Manager.