Zelle® is a fast, safe and easy way for small businesses to send money to, receive money from and request money from the customers and eligible vendors they trust. Transactions typically take minutes.2 If your customers use Zelle® within their financial institution’s banking app, they can send payments directly to your U.S. Bank bank account with just your email address, United States mobile number or code.

What is Zelle®?

Zelle® lets you send, receive and request money with your trusted customers and eligible vendors. If your customer uses Zelle® through their financial institution, they can send payments directly to your U.S. Bank account. Simply provide them with your email address or United States mobile number. The money will be withdrawn from their account and deposited into your account within minutes.2

Zelle® is available to consumers at over 2,000 financial institutions.

Enjoy the benefits of using Zelle®.

Easy

Skip the trip to the bank. Zelle® payments are deposited directly into your account.

Fast

Start to finish, a payment can typically be sent and received within minutes with enrolled users.2

Safe

There’s no need to provide your account information to receive payments2 with Zelle®.

Free

U.S. Bank offers Zelle® free to all small business checking and savings account clients.

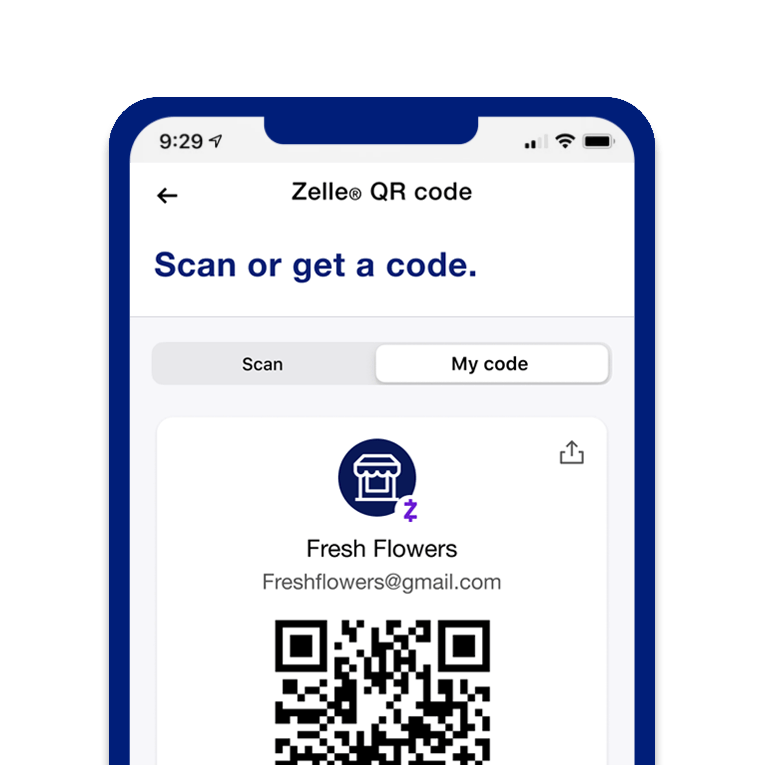

Make payments easier by scanning a code.

Give your customers the option to pay by scanning your code with the cameras on their smartphones.

Grow your financial knowledge.

Common small business banking questions

Get your business off to a good start by understanding the essentials of a business banking account.

Why digital payments are better

Along with speed, digital payment technologies offer increased access, ease, certainty and insights into your treasury management.

Business Resource Center

Manage your business and navigate the future with helpful knowledge and expert guidance.

Frequently asked questions

About Zelle®

To get started, you’ll need to enroll with Zelle®. Log into the U.S. Bank Mobile App or online banking and select Send Money with Zelle®.

Enter your email address or United States mobile phone number. We’ll send you a one-time verification code. Enter the code where prompted and accept the terms and conditions. You’re now ready to start sending, receiving and requesting money with Zelle®.

To receive money using Zelle® with a small business account, share your enrolled email address or United States mobile number with your customers and ask them to send you payment with Zelle® right from their banking app. No need to share any sensitive account details. After the customer sends their payment to you with Zelle®, you will receive your money directly into your enrolled bank account. Or if you’re using the mobile app, you may provide them with your code. (See information about codes below.)

To request money using Zelle® with a small business account, select Send Money with Zelle®, and then select Request. Enter the individual’s email address or United States mobile number, confirm the recipient is correct and tap Request.

If your customer is using Zelle® through their banking app, they’ll be able to pay you with Zelle®. You’ll receive a payment notification once your customer has sent you money in response to your request. If your customer is enrolled in the Zelle® app, they will not be able to send you money with Zelle®. You should arrange for a different payment method.

To send money using Zelle® with a small business account, simply select someone from your mobile device’s contacts (or add a trusted recipient’s email address or United States mobile number), add the amount you’d like to send and an optional note, review, then select Send In most cases, the money is available to your recipient in minutes.2

If the small business or consumer you’re sending money to is already enrolled with Zelle® through their banking app, the money will be sent directly to their bank account and cannot be canceled. Therefore, it’s important to only send money to people you trust. Always ensure you’ve used the correct email address or United States mobile number when sending money.

No. Sending, receiving and requesting money with Zelle® is free for all U.S. Bank clients.

Keeping your money and information safe is a top priority for U.S. Bank. When you use Zelle® within our online banking or mobile app, your information is protected with the same technology we use to keep your U.S. Bank account safe.

Getting started

Log into your business banking account via the U.S. Bank Mobile App or online banking using your business banking user ID. Select Send Money with Zelle® and then do the following:

- Select a United States mobile phone number or email address that you wish to enroll with Zelle®.

- You’ll receive a one-time verification code which you’ll enter when prompted.

- Select an eligible small business account.

Note: You cannot use the same United States mobile number or email address on more than one account. You must enroll a different email address or United States mobile number with each bank account.

No. Zelle® does not integrate directly with accounting software at this time. However, since Zelle® is connected to your U.S. Bank account, you’re able to see all your Zelle® transactions in your online banking transaction records. You can then download those transactions to accounting software.

For security reasons, we limit the amount of money you can send through Zelle®. Your current Zelle® limits will be displayed on screen at the time of your Zelle® transaction. You can also find your limits by following these directions:

Via the mobile app:

- For the best mobile banking experience, we recommend logging in or downloading the U.S. Bank mobile app.

- Select the main menu in the upper left corner of the page, then choose Help & services.

- From there, scroll to the Account services section and select Know your transaction limits.

- Scroll to the Zelle® limits section to find the information that applies to your daily or 30-day limit.

Via online banking

- To get started, log into online banking and follow these steps:

- Select My Accounts at the top of the page, then select the account you'd like to view your limit for.

- From the three tabs in the middle, select Account services and then Transaction limits.

- Scroll to the Zelle® limits section to find the information that applies to your daily or 30-day limit.

At U.S. Bank, there are no limits to the amount of money you can receive with Zelle®. However, remember that the person sending you money will most likely have limits set by their own financial institution on the amount of money they can send you.

In order to use Zelle®, the sender's and recipient’s bank or credit union accounts must be based in the United States.

Receiving money

- Enroll your eligible business checking or savings account with Zelle® through the U.S. Bank Mobile App or online mobile banking.

- Share your enrolled United States mobile number, email address or code with your customers who are enrolled with Zelle® directly through their financial institution. There’s no need to share any sensitive account details.

- After the consumer sends you payment with Zelle®, you will receive your money directly into your enrolled bank account.

Once you’re enrolled with Zelle®, it should typically only take a few minutes to receive money sent by another enrolled user.

You can receive money from other eligible businesses if their financial institution offers Zelle® to businesses.

You can receive money from consumers if they are enrolled with Zelle® directly through their bank. At this time, you’re not able to receive payments from consumers who are only enrolled in the Zelle® app using a debit card.

Tell them it’s a digital payment method that allows users to send money to each other’s checking or savings accounts.

There are several ways.

- Tell them verbally and, if needed, explain they can easily send you money right from their banking app.

- Give them a visual cue by posting your code in visible places, such as your marketing materials, bulletin board, etc.

- Say as much on your invoices. We recommend adding, “I accept payments with Zelle®.”

- You can request money with Zelle®. They’ll receive a notification telling them you’ve requested payment with Zelle®.3

- Visit Zellepay and download free Zelle® marketing assets, then add them to your website, social media and more.

Please note, you’ll only be able to receive payments from consumers or businesses using Zelle® through their financial institution’s mobile banking app. You will not be able to receive payments from consumers or businesses enrolled through the Zelle® app using a debit card.

Via the mobile app:

- Select Zelle® from the quick-action menu.

- Choose Request money with Zelle®.

- Enter your customer’s United States mobile number or email address that they have enrolled with Zelle®. Or, if you’ve already completed Zelle® transactions together, you can simply select the individual from your recipient list.

- Enter the amount you’d like to request. You can include an optional note.

- Review and select Request.3

Via online banking:

- Select Send Money with Zelle®.

- Choose Request.

- Follow the same directions.

Note: If your customer is using Zelle® through their bank’s mobile app, they’ll be able to pay you with Zelle®. If your customer is using Zelle® through the Zelle® app with their debit card, they will not be able to pay you with Zelle®. You’ll need to arrange for a different payment method.

Sending money

To send money to a trusted recipient:

- Log into the U.S. Bank Mobile App or online banking

- Select Send Money with Zelle®.

- Select a United States mobile phone number or email address from your contacts or scan their code. Enter the amount you wish to send.

It’s important to send money only to people or businesses you know and trust.

You can send money to other eligible businesses that bank with a financial institution that offers Zelle® to businesses.

You can also send money to consumers who use Zelle® directly through their bank’s mobile app or online banking. At this time, we don’t support sending money to (or receiving money from) consumers who are enrolled with the Zelle® app using a debit card.

You can only cancel a payment if the small business or consumer you sent money to hasn’t yet enrolled with Zelle®. You may also cancel a pending Zelle® payment that the Recipient has not claimed.

If you send money to a small business or consumer that has already enrolled with Zelle® through their bank or credit union’s mobile app, the money is sent directly to their bank account and cannot be canceled. This is why it’s important to only send money to people you know and trust, and always ensure you’ve used the correct email address or United States mobile number when sending money.

If you try to send money to a consumer who is enrolled in the Zelle® app, the payment won’t go through, and a message will pop up to let you know the payment cannot be completed. With small business accounts, Zelle® does not currently support sending or receiving money to users enrolled in the Zelle® app.

Once a request to send money using Zelle® has been processed, it cannot be modified or canceled.

Neither U.S. Bank nor Zelle® offer purchase protection for payments made with Zelle®.

If you notice something's not right with a Zelle® transaction on your account, such as a Zelle® transaction for a purchase you did not authorize or are unsure of, contact U.S. Bank immediately at our Fraud Liaison Center (877-595-6256).

More information related to reporting errors and unauthorized transactions specifically can be found in Your Deposit Account Agreement and the Digital Services Agreement.

A code allows information to be stored and accessed via scanning devices, like a scanner or a smartphone. Once scanned, the code can be used to send and receive money. To locate your Zelle® code:

Via the U.S. Bank Mobile App:

- Log in to your account.

- Select the Send money icon at the bottom of your dashboard.

- Choose the squares icon to the right of Manage recipients.

- Your Zelle® code will display. Select the Upload icon to share the code or to print it from your device.

Via online banking:

- Log in to online banking.

- Select the Send money command, then select Send money with Zelle®.

- Choose Zelle® code listed below the Activity button.

- From there you’re able to copy, download or print your Zelle® code.

- Open the U.S. Bank Mobile App or log in to your account through online banking.

- Navigate to Send Money with Zelle®.

- Select the code icon.

- Select the My Code tab.

- Use the print and share icons to text, email or print your Zelle® code.

- Provide the code to your customer. They will then follow the instructions within their financial institution’s mobile app to complete the transaction.

Yes. You can only have one Zelle® code for each enrolled bank account. If you have a personal bank account enrolled with Zelle® and a business bank account enrolled with Zelle®, each will have a unique Zelle® code.

No. If you are not enrolled with Zelle®, scanning a Zelle® code will not enroll you with Zelle®. Prior to scanning a Zelle® code, open the U.S. Bank Mobile App, navigate to Zelle® and follow the prompts to enroll. Once enrolled, you can scan the code from within the U.S. Bank Mobile App.

No, each Zelle® code is specific to an individual email address or United States mobile phone number. If you change either, your Zelle® code will change. You must share your new Zelle® code to receive money. Money sent to a Zelle® code that is not associated with an enrolled email address or United States mobile phone number will be set as Pending and the money will not move into your bank account unless you re-enroll the email address or United States mobile phone number. The payment will expire after 14 days.

There are several ways, but the easiest is:

- Find Zelle® in the U.S. Bank Mobile App.

- Send money. Select the code icon displayed at the top of the Select Recipient screen.

- Point your camera at the recipient’s Zelle® code.

- Enter the amount you wish to send.

- Select Send and the money is on its way.

Please call U.S. Bank 24-Hour Banking at 800-USBANKS (872-2657).