Protecting your assets

Your finances and business are in safe hands with U.S. Bank. As an FDIC-insured bank, we cover deposits with zero fraud liability. Plus, your data is protected by the industry’s strongest encryption.

Whether you’re starting a business, eyeing expansion or steadily perfecting operations, U.S. Bank offers a variety of accounts, financing and services to support you through it all.

2000+

Branches nationwide

One of the World’s Most Admired Companies

$7.8 billion

In small-business and small-farm loans

Featured customer

It’s comforting to know that your bank is always trying to find ways to help you grow your business. U.S. Bank has always been there for us.

Juan Andrade, Durango Barber Salon, U.S. Bank client

Looking for something specific? Speak with a specialist >

With U.S. Bank’s deep roster of industry experts and business solutions tailored to your needs, you can focus more on your passion and leave the grind of banking, payment processing and financing to us.

Stress less about high startup costs, expenses and fickle mother nature with loans, credit options and banking solutions to support you through every season.

Confidently manage your healthcare business with financing, payment solutions and dedicated support from our healthcare industry experts.

Whether you need cash flow tools, equipment financing or supply chain management, we’ll work with you to find strategic solutions for your biggest obstacles.

While you support others, our unique nonprofit checking account, credit card and lending options are here to support and expand the impact of your business.

Get a better handle on cash flow, easily create invoices and eliminate payroll hassles for accounting, advertising, legal services firms and more.

From financing equipment loans and startup costs to taking payments at the jobsite or online, U.S. Bank has the solutions to nail down the next phase of your contracting business.

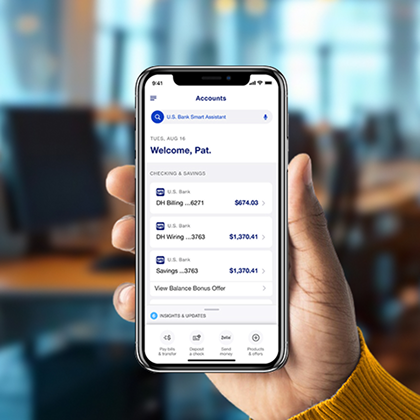

Track your business deposits and spending anytime, anywhere with U.S. Bank’s mobile banking app. It’s simple, secure and earns top-tier ratings.

Virtually connect with a banker and securely share your screen in the U.S. Bank website or banking app to talk through your business finances, goals and questions in real time.