Find your bank routing number.

Your routing number is printed in the bottom-left corner of your checks, but you can find it in other ways, too.

Add money to your account and make banking easy, 24/7, with the U.S. Bank Mobile App.

The U.S. Bank Visa® Debit Card is a simple way to buy what you need. Let's set yours up.

Want a safer, easier way to deposit your paycheck, plus faster access to your money?

Learn more about fees that may apply to your U.S. Bank Smartly® Checking account.

Whether you bank in the mobile app or online, you can opt in to receive up-to-the-minute notifications of account activity, to help you stay informed and secure.

U.S. Bank offers special benefits to youth and young adults. Youth must apply for an account jointly with an adult. Young adults may apply individually or jointly.

Once you've ordered checks you'll receive an email confirmation from our check vendor, Deluxe. They'll send an additional email once your checks have been mailed. You should receive your new checks in the mail within 5 to 13 business days from the date you order.

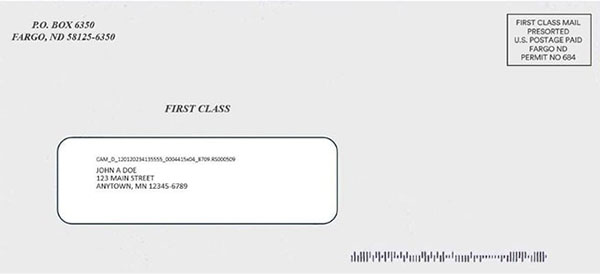

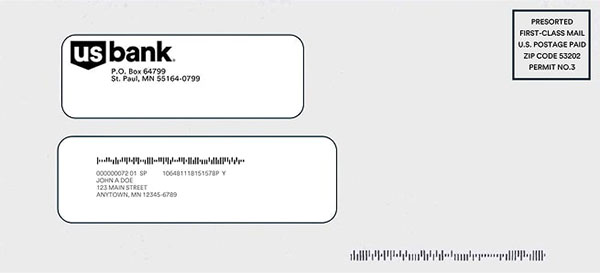

You'll receive your debit card within 7 to 10 business days after your account is funded. An initial deposit needs to be made before your card and PIN are mailed. After you've funded your account, your card will be sent in a white, unbranded envelope for your protection.

Sample of card mailer

Sample of PIN mailer

An account number or debit card information is required to enroll in the mobile app or online banking. For us to mail your debit card and PIN information, you must first make an initial deposit to your new account. Once that is complete, your card and PIN will be mailed and arrive within 7 to 10 business days. Use your new card and PIN to enroll in the mobile app or online banking. You will be able to view your new account number once logged in.

You can add or update a beneficiary on your U.S. Bank checking, savings and CD accounts. For details, see How do I add, change or remove a beneficiary?

Browse top customer service questions - and if you still can't find what you're looking for, we're always just a phone call away.