News

New to U.S. Bank? Switch your paycheck direct deposit in minutes

U.S. Bank is first large bank to automate direct deposit switching.

One of the biggest inconveniences when opening a new checking account is switching your paycheck direct deposit.

The time-consuming and manual process of filling out paperwork and finding routing and account numbers is something we’d all love to do without.

And with U.S. Bank, now you can.

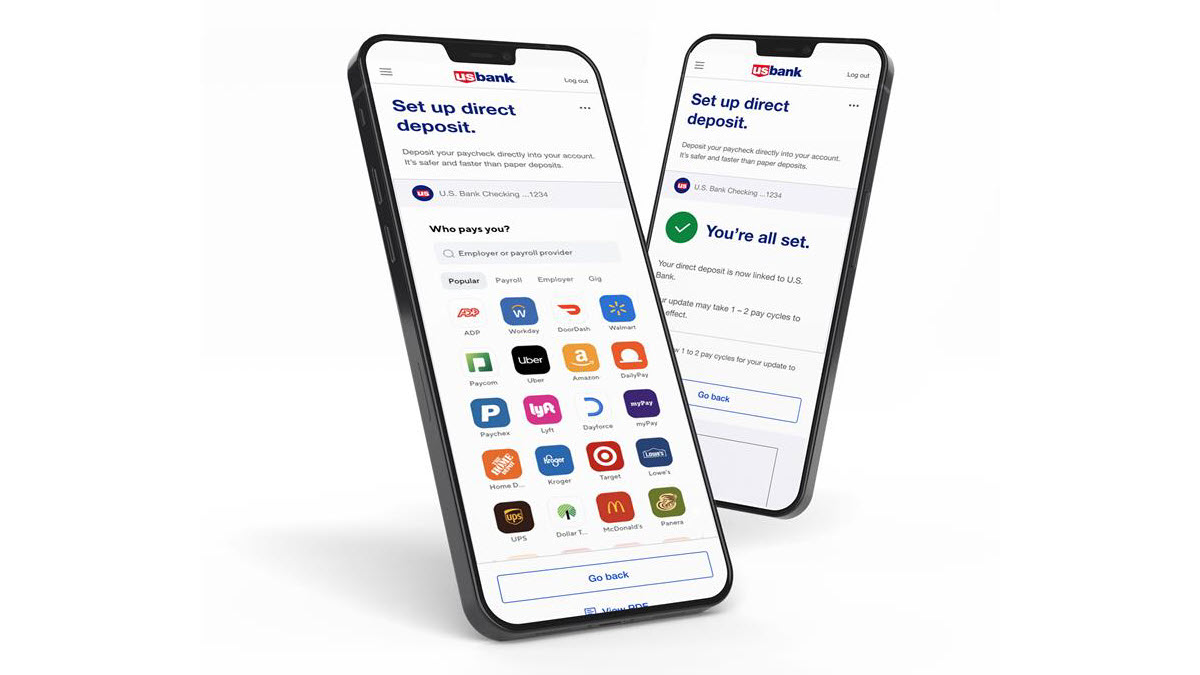

Thanks to the new DIY direct deposit feature, clients opening new U.S. Bank checking accounts can now switch their payroll direct deposit in just minutes, as part of the bank’s new enhanced account onboarding experience.

The new secure and automated process is available on the U.S. Bank Mobile App and online banking and reaches over 85% of the U.S. workforce, including many companies within the gig economy. In just minutes, clients can search for their payroll provider, sign into their corresponding employer account and receive confirmation that their payroll direct deposit has been successfully switched. Very few banks have any feature like this, and U.S. Bank is the first large bank to fully automate the process and provide clients with instant confirmation that it was successful.

“Our new DIY direct deposit feature is yet another way we are helping our clients save time and simplify banking,” said Tim Welsh, vice chair, Consumer & Business Banking at U.S. Bank. “We know the traditional process is a pain point for many, so it is exciting to be the first large bank to offer an automated and secure process for direct deposit switching so our clients can get back to the things that matter most.”

The feature is available to clients opening new U.S. Bank Smartly® Checking or Safe Debit checking accounts and utilizes infrastructure powered by Atomic, the market-leading provider in payroll connectivity services.

“We are constantly innovating at U.S. Bank to offer a digital-first experience for our clients,” said Dominic Venturo, chief digital officer at U.S. Bank. “Early data shows the DIY direct deposit feature is popular with clients and is the latest example of how we are putting them first. We continue to find new ways to improve the overall banking experience with advanced functions and capabilities that make banking easier and more enjoyable.”

The company recently simplified its approach to checking accounts with U.S. Bank Smartly Checking and U.S. Bank Smart Rewards® program, which rewards clients with exclusive benefits based on their overall relationship with the bank, and has revised and eliminated a number of overdraft fees and policies, including U.S. Bank Overdraft Fee Forgiven.

The new direct deposit feature adds yet another amazing function to the award-winning U.S. Bank Mobile App, which is ranked No. 1 in the industry. The bank continues to receive top accolades, including most recently from Insider Intelligence, which reported in its 2022 Mobile Banking Scorecard that customers looking for a new bank list mobile as their top consideration. The publication noted that “U.S. Bank offered features that mattered most” when ranking the bank first. And the best part is, the U.S. Bank Mobile App keeps getting better, with new features added every month.

Media center

Press contact information, latest news and more

Learn more

Company facts, history, leadership and more

Work for U.S. Bank

Explore job opportunities based on your skills and location