NEWS

Act now to jump-start 2025 savings goals

December 4, 2024

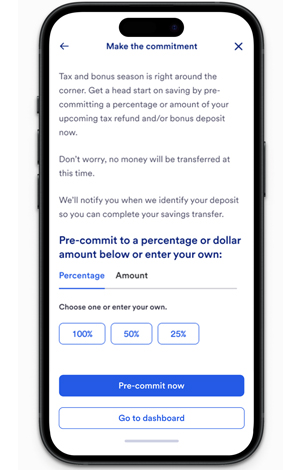

New digital tool enables U.S. Bank clients to be proactive about saving by pre-committing

For many Americans, the largest deposit into their checking account each year – and best opportunity to set aside a little extra – is a tax refund check or annual bonus. That’s why beginning in December, U.S. Bank clients can pre-commit a portion of their anticipated tax refund or annual bonus to savings, to help jump-start their savings goals in 2025.

The new pre-commitment digital tool prompts clients to select an amount or percentage of their refund or bonus to allocate to savings. When their refund or bonus is identified, they’ll be alerted to logon and complete the transfer.

The act of pre-committing has shown to have a positive impact on savings outcomes. In fact, a study by Science Direct showed that early tax fillers who pre-committed a portion of their refund to savings saved 25% more than those who didn’t pre-commit.

“Making a plan is the first step towards accomplishing any goal – and for many of our clients an especially important goal is to save more money,” said Derik Farrar, head of deposits at U.S. Bank. “With our new pre-commitment tool, we’re making it easier to plan for and prioritize saving today, which will help set our clients up for success in the New Year.”

A new option for savers to earn even more on their savings balances is the U.S. Bank Smartly Savings account. Launched in September, Smartly Savings account holders can earn competitive rates on their savings balances when paired with a Bank Smartly® Checking account or U.S. Bank Smartly™ Visa Signature® Card.

In addition to offering new and compelling ways to save, the bank is making it more rewarding and empowering to be a client. In June, U.S. Bank launched a partnership with leading family fintech Greenlight to help more families teach their kids about money. Through the partnership, eligible checking account holders can enjoy complimentary access to the Greenlight debit card and money app, all within the U.S. Bank Mobile App.

For more information about savings options at U.S. Bank, visit www.usbank.com/savings.

(Editor’s Note: The content of this article is accurate as of publication on December 4, 2024 and may have changed. For the latest product information, refer to the Consumer Pricing Information (PDF) disclosure or visit the Bank Smartly Checking and Smart Rewards product pages.)

Media center

Press contact information, latest news and more

Learn more

Company facts, history, leadership and more

Work for U.S. Bank

Explore job opportunities based on your skills and location