We’re strong and stable, and we stand out. Our business model isn’t like every other bank, and that’s intentional. Within our three primary revenue lines, we have more than 50 business areas generating “through cycle” earnings power. That power extends to our clients. With unique offerings from Corporate Payments and Corporate Trust to Capital Markets and Asset Management – just to name a few – we’re able to bring the whole bank to our clients as trusted consultants helping power potential.

Consumer and Business Banking

Wealth, Corporate, Commercial and Institutional Banking

Payment Services

Global merchant acquiring

The launch of U.S. Bank Avvance™, our new flexible financing solution

With payment methods and consumer expectations constantly evolving, we introduced our new multichannel point-of-sale lending solution, U.S. Bank Avvance™, in the fourth quarter of 2023. Avvance enables businesses to offer consumer financing during checkout with a quick application and instant decisioning. Additionally, the solution provides a transparent, convenient way to pay over time. Loan offers are personalized, providing flexibility while making it easy for customers to see how much they would pay. For business owners, Avvance is embedded in the checkout process, enabling them to offer their customers convenience from a trusted provider without the hassle of managing payments after the sale.

Retail payment solutions

U.S. Bank offers recycled plastic for Altitude Go

ln September, we announced that U.S. Bank will issue credit cards made from recycled plastic for the entire U.S. Bank Altitude® Go Visa Signature® and U.S. Bank Altitude® Go Secured Visa® credit card lines, as well as U.S. Bank Altitude® Go World Elite Mastercard®. Additionally, cardholders can redeem earned points as a contribution toward a variety of nonprofits listed in the Altitude Rewards Center. U.S. Bank will match each point donation made for Altitude Go cardholders – doubling the value of donations to cardholders’ selected nonprofits.

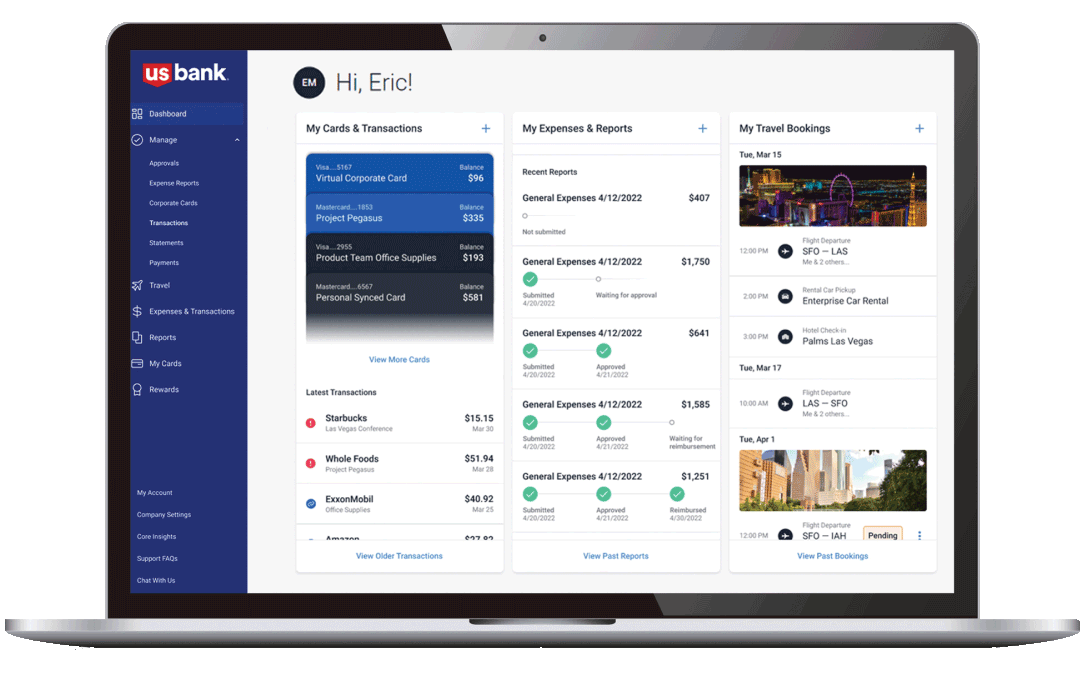

With many companies looking for ways to simplify the time, effort and dollars spent processing employee expense reports, we continued our ramp up of digital payment solutions in 2023. Together with our wholly owned subsidiary, TravelBank, we developed the Commercial Rewards Card, an innovative solution to help emerging middle market companies control and monitor business expenses in real time. The solution integrates controls and workflows into one card, expense and travel management platform designed especially for mid-size companies, helping them replace time-consuming manual processes with a single, integrated tool for business expense, travel and card management. Additionally, real-time data gives clients greater control, improved productivity, visibility into business spending and an easier experience for employees to track their expenses via a suite of integrated products.

~1.3K

financial institution clients that we issue credit cards for

Accelerating business payment options

Business clients of both U.S. Bank and Kyriba, a global leader of cloud-based finance solutions, can now easily send instant payments to vendors, customers, and employees from their U.S. Bank® accounts within their existing Kyriba dashboard thanks to our new API-powered payment connectors. The collaboration with Kyriba’s Real-time API Connectivity Network integrates banks, enterprise resource planning systems, trading portals, data services and payment apps using pre-built connectors to improve business continuity and minimize IT time and cost. For clients of U.S. Bank and Kyriba, these connectors reduce time and resources required to enable new payment methods. In addition to instant RTP® Network payments, joint U.S. Bank and Kyriba clients can leverage the API connectors to send Zelle® payments. The embedded payment solution also provides businesses with real-time visibility into bank account balance and transaction reporting, which helps improve cash flow management.

Business banking

New initiative offers banking, payments and wealth management for small-to-midsize healthcare practices

We’ve served healthcare organizations for more than 100 years, but in 2023, we began a new cross-business initiative to serve a growing and new-to-us segment of healthcare practices that have up to $25 million in annual revenue. A specialized team with expertise from banking, payments and wealth management delivers a comprehensive suite of solutions for medical, dental and veterinary practices and practice owners, as well as physician-owned medical and diagnostic laboratories and outpatient care centers. The high-touch service is led by a healthcare banker who can bring solutions and advice designed to strengthen the client’s practice, improve their patient payment experience, and help them achieve their personal financial goals. The services are designed to help simplify finances and operations for these practices, so practitioners can spend more time on patients and less time on administrative tasks.

Continued growth via our alliance with State Farm

In 2020, we teamed up with State Farm to provide banking solutions and services to consumers and small businesses through State Farm agents. Three years later, we continue to grow our relationship.

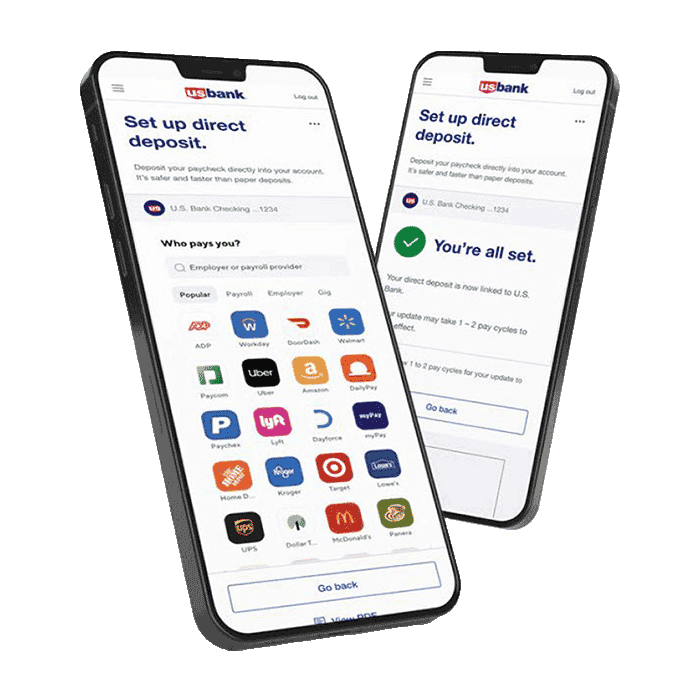

The first bank to automate direct deposit switching

Operational improvements directly impact our clients, for the better. One example in 2023 was our new DIY direct deposit feature, which enables clients opening new U.S. Bank® checking accounts to switch their payroll direct deposit in just minutes, as part of the bank’s new enhanced account onboarding experience. The time-consuming and manual process of filling out paperwork and finding routing and account numbers is something clients can now do without.

The secure and automated process is available on the U.S. Bank® Mobile App and online banking and reaches over 85% of the U.S. workforce, including many companies within the gig economy. In just minutes, clients can search for their payroll provider, sign into their corresponding employer account and receive confirmation that their payroll direct deposit has been successfully switched. Very few banks have a feature like this, and U.S. Bank is the first large bank to fully automate the process and provide clients with instant confirmation that it was successful.

Growing our business with first-to-the-market solutions

Among our 2023 highlights, we became the first U.S. financial lender to offer a direct-to-consumer recreational vehicle (RV) and boat purchasing experience. U.S. Bank and Rollick teamed up to provide consumers and dealerships with a streamlined buying experience via the U.S. Bank® RV and Boat Marketplace, where shoppers can search dealer inventory and apply for financing at participating dealers nationwide. The marketplace – available on the U.S. Bank® website and U.S. Bank® Mobile App – is accessible to clients and non-clients of the bank, and all boat and RV dealers using U.S. Bank as a lender can participate in the program at no cost.

Building on U.S. Bank Access Home with a new loan program

In July, we expanded access to homeownership with the launch of U.S. Bank Access Home™ Loan, a mortgage Special Purpose Credit Program (SPCP) that provides up to $12,500 in down payment assistance and up to an additional $5,000 lender credit for home buyers to buy down their interest rate. Access Home Loan provides financial assistance for buyers in 11 pilot areas – including six in California – where the minority population is more than 50% according to census tract data. We closed the first program loan in 12 days for a single mother who’d been renting for 16 years. We’ve committed $100 million over the next five years to the program. The new offering is an extension of U.S. Bank Access™ Home and U.S. Bank Access Commitment®, our long-term approach to help close the wealth gap for underserved communities.

A new look for two of our business lines

In 2023, U.S. Bank Wealth Management, Corporate, Commercial and Institutional Banking (WCIB) came together to form one unit. This expansive franchise has talented professionals with client relationships that sometimes go back 100 years, represent $10.6 trillion in assets under custody and administration, and $454 billion in assets under management. Its digitally innovative products across banking, investing, and servicing capabilities serve clients across a diverse set of industries from manufacturing to agriculture; hospitality to governments; asset managers, insurance companies, universities and wealthy families – and more.

Asset Management

Growing our outsourced chief investment officer business

The increasing complexity of portfolios and regulatory requirements, combined with market volatility, means that many institutions are reevaluating their approach to managing investment portfolios and choosing to “outsource” this expertise. As part of our steadily growing outsourced chief investment officer (OCIO) business – a fee-based revenue generator for U.S. Bancorp Asset Management Inc. – we added a head of distribution for our institutional OCIO practice, housed within our subsidiary, PFM Asset Management LLC. The team supports the firm’s consultant relationships, as well as not-for-profit, corporate, public sector and Taft-Hartley clients.

+500K wealth clients

+30K institutional and government clients

Institutional

Tailored portfolio optimization now available to CLO clients

Collateralized loan obligation (CLO) clients now have access to comprehensive insights for faster and more effective trading with our new portfolio optimization capabilities. Using a set of criteria selected by the client, Pivot Portfolio Optimization sorts through tens of thousands of potential portfolio combinations to identify a combination of investments that best advance the client’s stated objective – typically, maximizing the weighted average spread of the CLO. U.S. Bank focused research and development on two priorities: calculation speed and seamless execution, and U.S. Bank currently has one patent granted and another pending covering Pivot Portfolio Optimization capabilities on these critical features.

New ETF servicing capability for clients in Europe

In the spring of 2023, we launched our new exchange-traded fund (ETF) services in Europe, along with our first client for the offering. U.S. Bank supports Horizon Kinetics’ European version of its Inflation Beneficiaries ETF, an actively managed fund that seeks to address one of the most important economic and investment drivers – inflation – by identifying unique, scalable businesses that have the potential to thrive in an inflationary environment. The fund is structured as a UCITS ETF and trades on Euronext Amsterdam. U.S. Bank provides clients with a holistic offering, including fund administration, transfer agency, depositary and global custody solutions, as well as several specialized European exchange-traded fund services.