Key takeaways

Choosing your situs of trust doesn’t have to be in your state of residence.

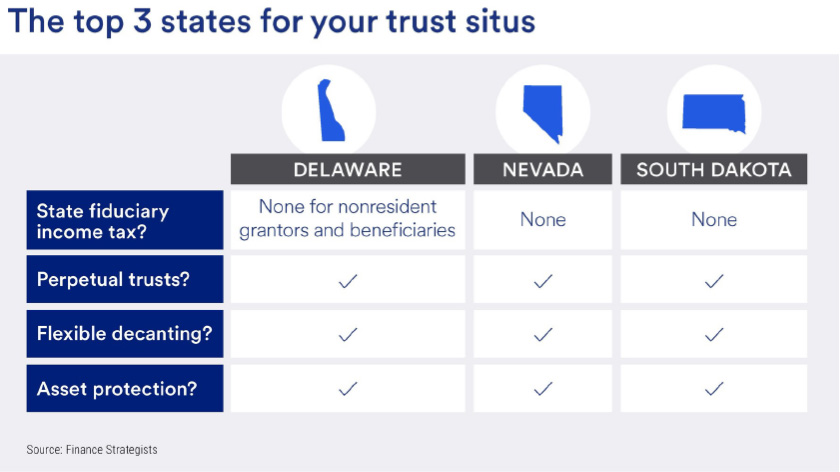

States with favorable trust situs laws include Nevada, South Dakota and Delaware.

Your legal, tax and financial professionals can evaluate various trust situs options and help you choose one that is appropriate for your circumstances.

Trusts are an integral financial and estate planning tool for families and individuals with significant wealth. While choosing the right kind of trust for you is critical, it’s just as important to choose the right location for the trust’s administration. This is known as the trust situs.

Contrary to popular belief, trusts don’t have to be established in your state of residence. As long as there are sufficient connections to the state, you can set up a trust in any state you like.

“Some states have modified their laws to make them more favorable for trusts than others,” says Nate Rothbauer, managing director of wealth strategy for Ascent Private Capital Management of U.S. Bank. “This makes deciding trust situs critical, especially for wealthy families with large trusts.”

In addition to determining the situs of a trust, you can move an existing trust to a new state with more favorable trust laws.

What state should I set up my trust situs?

What makes a state attractive for trust situs? In short, it’s the state laws that govern the tax treatment, duration period, asset and creditor protection, decanting and modification provisions, and privacy of irrevocable trusts.1

“These laws tend to be the main things that affluent clients look at when deciding about trust situs,” says Justin Flach, managing director of wealth strategy for Ascent. “Choosing the right trust situs can provide significant benefits in each of these areas.”

Nevada, South Dakota, Delaware, Alaska and Wyoming are generally recognized as the states with the most favorable trust laws and regulations. These states generally have a favorable tax environment, strong asset and privacy protection laws, and flexible decanting provisions and trust modification options.

State tax treatment of trusts

States have varying tax structures affecting trusts. For example, undistributed trust income is subject to state income taxes in some states but not in others.

“Establishing trust situs in a favorable state could make a big difference when selling a family business,” says Flach. “For example, the proceeds could be subject to a 12.3% state income tax in California, but zero state income tax in some other states.”

State-level inheritance and estate taxes can also have a big impact on how much wealth is transferred to beneficiaries. Therefore, make sure you understand state tax thresholds, exemptions and rates when deciding trust situs.

State trust duration period

Some states allow for perpetual trusts, while others limit trust duration. If you intend to establish a dynasty trust to benefit multiple generations, then you will likely want to set it up in a state with a long duration period.

“Some states allow trusts to last in perpetuity, or essentially forever,” says Rothbauer.

Asset and creditor protection of trusts

Trusts can offer high levels of asset protection from creditors, divorce and civil judgments. However, some states offer stronger protection than others, depending on case law and statutory regulations.

“Choosing the right trust situs is critical to a trust’s tax efficiency, asset protection, privacy and effective operation.”

Justin Flach, managing director, wealth strategy, Ascent Private Capital Management of U.S. Bank

In some states, for example, there’s more protection against creditors piercing through to trust assets or offering shorter lookback windows for transfers to trusts. And some states offer spendthrift provisions and fraudulent transfer laws that help secure trust assets and prevent unauthorized creditor access.

Trust decanting and modification provisions

Decanting refers to the ability to transfer assets from one trust to another trust with more favorable terms. Generous decanting and modification provisions, including both judicial and non-judicial modifications, increase a trust’s flexibility to adapt to changing circumstances.

“This can be useful when it comes to protecting the settlor’s intent and the beneficiaries’ best interests,” says Flach.

Directed trusts—trusts that divide the responsibility for the management of the trust between at least two people—also provide greater flexibility. These allow you to give someone other than the trustee authority over some or all aspects of trust administration. Different states have different rules governing directed trusts, so you may want to consider this when choosing trust situs.

Trust privacy

Privacy protections for trusts also vary widely from one state to the next. This makes it critical to analyze a state’s laws to ensure the confidentiality of all trust matters.

For example, silent trusts restrict the information that can be disclosed to beneficiaries. And choosing a state that allows court records to be sealed can help protect sensitive trust information from the public.

Professionals can support your situs of trust decision

It’s imperative to work closely with professionals, including an estate planning attorney, when determining situs to ensure that you make the best decision based on your goals and circumstances.

“Choosing the right trust situs is critical to a trust’s tax efficiency, asset protection, privacy and effective operation,” says Flach. “Our trust professionals work closely with our clients’ tax and legal advisors to provide guidance in the process and take care that the appropriate steps are taken in establishing trust situs.”

Learn more about trust and estate services from U.S. Bank.

Tags:

Explore more

How to prepare for your trust planning meeting

What you need to know to make your first meeting with an estate planning attorney as successful as possible.

Legacy planning for the people and causes you care about most.

From trust and estate planning to administration, we can partner with you to help protect those you love, today and tomorrow.