Key takeaways

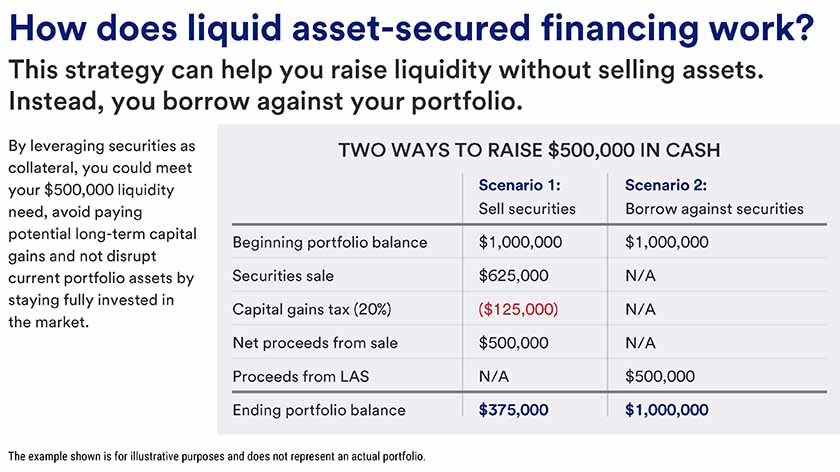

Liquid asset secured financing offers flexibility and liquidity, which can be valuable if you need cash for an unexpected financial opportunity or challenge.

If you’re considering using liquid asset secured financing, keep in mind that these lines of credit have adjustable interest rates and the amount you have available to borrow is tied to the value of your investment portfolio.

Liquid asset secured financing is a flexible line of credit secured by eligible assets in one or more of your investment accounts.

“In essence, your investment portfolio serves as collateral for a loan,” says Vivian Chow, senior vice president and regional banking manager at U.S. Bank. “This type of financing provides consistent liquidity and financial flexibility, allowing you to use your investments under various economic conditions.”

“Regardless of market fluctuations or interest rate changes, providing clients access to cash without disrupting their investment goals is important.”

Vivian Chow, senior vice president and regional banking manager at U.S. Bank

How to use your assets as cash

Liquid asset secured financing, also known as securities-based line of credit or portfolio line of credit, requires no personal financial statement or tax returns for loans up to $10 million (like most lending options, however, it does require a loan application and underwriting). It offers both consumer and commercial clients attractive interest rates and flexible repayment of principal. In addition, liquid asset secured financing features a streamlined application, expedited approval process and on-demand access to available funds.

You can use the cash to meet a wide range of financial needs:

- Pay taxes

- Quickly finance special purchases, such as a cash offer on real estate

- Manage short-term cash flow

- Serve as a bridge loan

- Refinance higher interest rate debt

Because this line of credit offers you flexibility and liquidity, it can be particularly useful when you’re presented with a sudden financial opportunity or challenge. In addition, the line of credit may give you better control over your finances.

As an example, you may need cash to close on a new home, but your portfolio is down due to market volatility. You don’t want to have to sell securities at a loss so instead take out a line of credit secured by your portfolio to generate the cash needed.

Or, if you’re a small business owner that needs cash to temporarily cover payroll and other expenses, you can take out a line of credit secured by your business or personal portfolio. “Even nonprofit organizations are putting these types of loans into place,” Chow says. For example, in years when donations and grants are not adequate, a nonprofit may have difficulty lining up the timing of projects. Rather than liquidating endowment funds or pursuing more expensive financing to cover operating expenses, a nonprofit can use a portion of the endowment fund as collateral without disrupting overall investment objectives.

Considerations with liquid asset secured financing

As with any financing option, it’s important to understand how the economic environment may impact your ability to borrow and how much it may cost. There are two factors in particular to keep in mind when considering liquid asset secured financing.

Interest rates

Liquid asset secured loans have adjustable interest rates that are based on a benchmark rate, meaning the cost of borrowing can change over time. When interest rates are stable or going down, these loans are especially beneficial as they can lead to consistent or even lower borrowing costs. However, if interest rates are expected to increase, securing financing early can help you get a better rate.

Liquid asset secured financing is particularly useful for short-term financial needs, typically from a few months up to a few years, as this minimizes the impact of potential interest rate changes. For financial needs that extend beyond the short-term, considering a loan with a fixed interest rate might be a better fit, offering more predictability in the long run.

Portfolio volatility

Because the amount you have available to borrow is tied to the value of your overall portfolio, if the market experiences a decline, the overall value of your portfolio, or collateral, is also reduced. If your collateral is worth less, you may be asked to bring the outstanding loan amount back into alignment with the overall value of your portfolio. This is known as a margin call. If this happens, you’ll have to repay part of your loan, provide additional collateral, or sell some of your assets to cover the shortfall, which could create a tax liability.

Chow says, “We monitor the market daily, so if a fluctuation occurs, it would be detected immediately. We’d then work with you to resolve the situation and bring the account back into margin as soon as possible.” You should keep in mind the need for a secondary funding source or a means to readily pay the line of credit down or add additional eligible collateral in the event of a margin or maintenance call.

A downward market fluctuation could also reduce the amount you can borrow, as it’s directly tied to the value of the assets you’re using as collateral. If the value of your collateral decreases, your flexible line of credit also decreases.

Know your options

Regardless of the interest rate environment and market circumstances, there will always be occasions and opportunities that may necessitate the need for extra funds. Your banker can help you determine whether financing secured against liquid assets is a suitable option for you.

Learn about U.S. Bank Wealth Management Banking services.

Explore more

Financial leverage: What is good debt vs. bad debt?

Debt gets a bad name, but not all debt is inherently bad. Learn how using “good debt” strategically can help you achieve your financial goals.

Banking products and services personalized for you.

Access to dedicated bankers, customized financing options and exclusive benefits that support your personal and business banking needs.