Key takeaways

Tax diversification involves building a mix of investment accounts with different tax treatments: fully taxable, tax-advantaged and tax-free.

Tax efficient investing allows you to have more flexibility in determining a distribution strategy that responds to changes in your tax rate.

It can also help you generate more income by taking strategic distributions from different types of investment accounts.

When you think of diversification, the first concept that might come to mind is a mix of investments across stocks, bonds and cash that can reduce risk. But for those saving for retirement, an equally important concept is the idea of building a tax-diversified portfolio.

What is tax diversification?

Tax diversification is when you build a stable of investment accounts that have different tax treatments: fully taxable, tax-advantaged and tax-free. A strategic use of all three can give you greater flexibility in retirement.

Types of investment accounts by tax treatment

Let’s look at the three types of investment accounts in terms of tax treatment.

Fully taxable investment accounts

A traditional brokerage account (generally comprised of stocks, bonds and mutual funds) is fully taxable. Other accounts, such as bank savings accounts and CDs held outside of a retirement plan, are also subject to current taxation.

Here’s what to expect from fully taxable accounts:

- The account is funded with after-tax money.

- You pay taxes on yearly dividends and interest earnings, as well as capital gains on appreciated assets you sell.

- With mutual funds, you will owe taxes on annual capital gain distributions.

- The applicable tax rate each year can vary depending on your tax bracket, how long you held an investment before it’s sold and whether dividends are considered qualified or non-qualified.

- You may be able to deduct realized investment losses, subject to certain tax rules, to offset realized gains and even a portion of earned income.

- Beneficiaries can take advantage of favorable tax rules, namely a step-up in cost basis for the specific assets you hold, after your death.

While fully taxable investment accounts offer few immediate tax benefits, they’re the most flexible in terms of uses and withdrawals. They’re good options if you’ve maxed out contributions to your retirement accounts and want to put more money to work to achieve your financial goals.

Tax-advantaged investment accounts

Retirement accounts such as 401(k)s, 403(b)s and traditional IRAs are considered tax-advantaged (also called tax-deferred).

- Accounts are funded with pre-tax, tax-deductible or after-tax contributions.

- Earnings are tax-deferred.

- You’re required to take annual minimum distributions (RMDs) beginning at age 73.

- Withdrawals and RMDs are taxed as ordinary income, which depends on your tax bracket.

- Withdrawals made before age 59½ may face an additional 10% penalty tax.

If you don’t have access to an employer-sponsored plan, a traditional IRA provides the same tax benefits, although there are different contribution limits: $23,000 for a 401(k) vs. $7,000 for a traditional IRA in 2024.

Traditional IRAs, 401(k)s and 403(b)s can help reduce your taxable income today, but, due to RMDs, they offer less flexibility when you’re determining when to take withdrawals in retirement. Because of the tax treatment of withdrawals, there is a risk that distributions could move you into a higher tax bracket in retirement.

Tax-free investment accounts

This category includes Roth IRAs and Roth 401(k)s for retirement. Other potentially tax-free savings vehicles include 529 college savings plans and Health Savings Accounts (HSAs).

- Most tax-free investment accounts are funded with after-tax money.

- An HSA can be funded with tax-deductible contributions or pre-tax income if you have a high-deductible health plan through your employer.

- Earnings are generally tax-deferred.

- Roth IRA or Roth 401(k) distributions are usually tax-free, if you take them after you turn 59½ and meet the holding period requirements. You’re taxed on earnings if you make withdrawals before age 59½, and a 10% penalty tax may also apply.

- HSA and 529 withdrawals are only tax-free if you use the money for qualified medical or education expenses, respectively.

- Roth account distributions are not subject to RMD rules.

The benefits of Roth accounts generally arrive as you near retirement. For example, since withdrawals from a Roth account are tax-free after age 59½, you could pay less income tax in the long run throughout retirement.

A tax-diversified portfolio in action

The greatest benefit of owning a tax-diversified portfolio is that it gives you more flexibility in retirement.

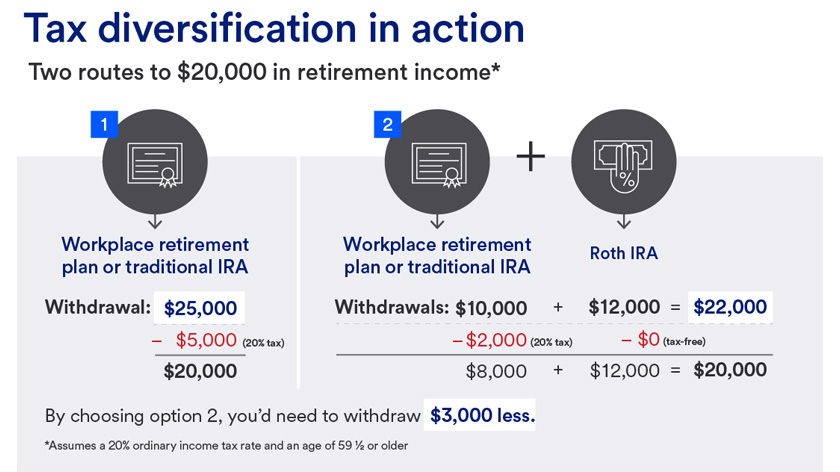

For example, consider distributions from an employer retirement plan or traditional IRA made with pre-tax contributions that will be fully taxable at ordinary income tax rates. Say you wanted to generate $20,000 of retirement income from your employer plan, and distributions were subject to a 20% tax rate. That would mean you would need to withdraw $25,000 from the plan to meet your income need.

But if you also had assets in a Roth IRA, you could reduce your total withdrawal amount. You could take a $10,000 distribution from your workplace plan (leaving you $8,000 after tax) and withdraw $12,000 tax-free from the Roth IRA—a total distribution of $22,000 instead of $25,000, to generate $20,000 in net income. This shows how tax diversification helps preserve more of your money to meet long-term needs.

Tax diversification also gives you more flexibility to determine a tax-efficient distribution strategy that responds to economic conditions. In years when taxes are higher, for example, you could take more tax-free distributions from your Roth IRA. And in years when your tax rate may be lower, you can take more taxable distributions from your workplace plan.

When it comes to lowering your taxes over a lifetime, awareness is key. Understanding when and how to choose the right investment account for your needs and life stage can help you minimize your tax bill and maximize your savings. Be sure to consult with your wealth planning professional and tax advisor to learn more about how to incorporate tax diversification into your long-term savings plan.

Learn how our team-based planning approach can help you review financial opportunities from all perspectives.