Key takeaways

First factor fees, commissions, capital gains tax and other expenses related to selling your home into your sale proceeds.

If you’re using the proceeds from the sale to purchase a new house, compare your current costs to past costs, and keep in mind that your new home may also have an inflated value.

If you’re using the profits from a house sale for something other than housing, your financial goals and objectives should guide your decision-making.

If you’re looking to sell your home and are hoping for a substantial profit, which was common the last few years, you may have to temper your expectations—but plenty of sellers are still in a position to walk away with a generous return. The question is, what should you do with the home sale proceeds?

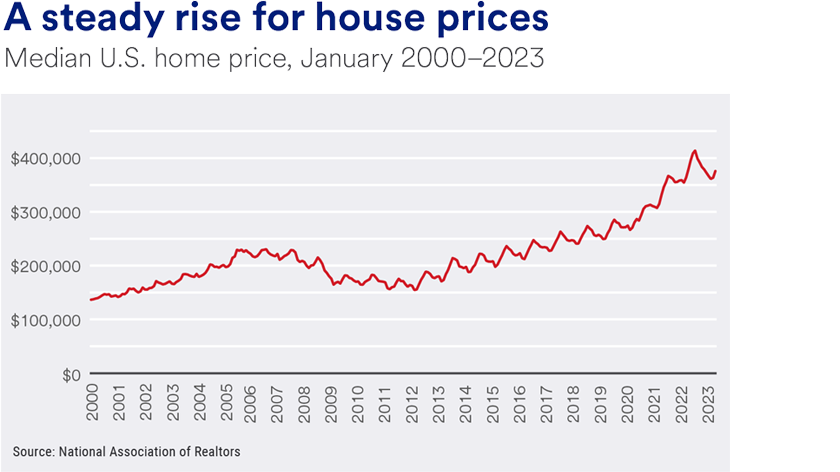

According to the National Association of Realtors, the median sales price of existing U.S. homes was $388,800 in April 2023, a 1.7% year-over-year decrease.1 That said, while prices have come down from the dizzying heights they hit in 2022, the median home price continues to rise over the long term; it was roughly $160,000 in 2010.2

That means that if you’re considering a sale, or if you’ve already sold your home, you’re likely to pocket a profit—especially if you’ve owned the home since before 2020.

“Once we have a better idea of what’s going on with your finances and plans for your life, we can give better guidance on where that money could go.”

LeAnn Erenberger, Wealth Management Advisor, U.S. Bancorp Investments

What to do with home sale proceeds

There are plenty of choices for what to do with the profit from a house sale. Common ways people spend the profits from a house sale include:

- Purchasing a new home

- Buying a vacation home or rental property

- Increasing savings

- Paying down debt

- Boosting investment accounts

But before making that decision, it’s important to take a step back, weigh the pros and cons of different options, and consider how those home sale proceeds could affect your current and future finances and overall financial planning strategy.

Deciding what to do with home sale proceeds is by no means a one-size-fits-all solution. “Just because your neighbor sells their house and puts all of the money into buying a new house or a rental property, it doesn’t mean that’s what you should do,” says Bailey Winter, Wealth Management Advisor for U.S. Bancorp Investments.

She notes that you must look at the various options in the context of your unique financial situation, financial goals and tolerance for risk.

Reserve profit from house sale as capital for expenses

Although it’s more enticing to focus on what to do with the potential profits from a sale, don’t forget to first factor in costs and other expenses related to the sale of your home that will affect your net proceeds. Some of those key expenses include:

- Fees associated with selling a house, such as the realtor commission and closing costs

- Potential tax consequences if your adjusted gross income increases

- Capital gains tax

- Relocation costs and/or costs of purchasing or renting a new home

Depending on the amount of proceeds and the type of home—whether it’s a primary residence—the sale of a home could make you liable for capital gains tax and/or push you into a higher tax bracket. Especially for retirees, that higher tax bracket could affect a fixed income that is now taxed at a higher rate.

Another consideration is that profit from a house sale could result in you needing to file estimated tax payments prior to your annual filing. And if you’re looking to roll capital gains from the sale of an investment property into the purchase of a new property as part of a 1031 tax deferred exchange, it’s especially important to have a plan in place to complete the exchange within the specific timeframe allowed by the IRS rules.

“We always advise our clients to understand the tax ramifications of a home sale and talk to their accountant, because you don’t want any surprises at the end of the year,” says LeAnn Erenberger, Wealth Management Advisor for U.S. Bancorp Investments.

Investing home sale proceeds in a new home

If you’re planning to use the profits from your house sale to purchase a different home, ask yourself a few questions. Are you upsizing or downsizing? If you’re buying a condo, do you understand all the fees and costs associated with that purchase? If you’re renting in the interim, do you have a clear idea of the costs to rent?

“People often look at the price tag of buying a new home but often neglect to factor in other out-of-pocket expenses that can affect their overall financial picture,” Erenberger says. For example, buying a bigger, more expensive home often means higher property taxes, utility bills and insurance costs. “You need to have a good understanding of what your future costs are going to be compared with your past costs,” she adds.

“You may sell your home for an incredibly high price, but you also might have to turn around and buy a new home at an equally inflated price,” notes James Erickson, Wealth Management Mortgage Banker for U.S. Bank Wealth Management. “If the market turns, that home might not be worth as much in a few years. So, you have to understand what the market is doing and the ramifications if you make changes.”

Investing home sale proceeds as part of a broader financial strategy

If you’re considering using the profits from a house sale for something other than housing, take a step back and consider your overall financial strategy. Analyze your current financial position, including income, assets and liabilities. What are your future goals and objectives? Where are you now, where are you headed and what is the plan to get there?

“Once we have a better idea of what’s going on with your finances and plans for your life, we can give better guidance on where that money could go,” says Erenberger.

“We use financial analysis software to model different scenarios to help take uncertainty and guesswork out of the equation,” adds Winter. “Our analysis might highlight the pitfall of putting all of the proceeds into a new home purchase when you don’t have other outside assets to rely on. Or it might show that you do have extra money, so it’s okay to go buy that dream house on the beach.”

The analysis also helps make sure that you’re accounting for the many factors that affect your finances, such as inflation and market volatility. “By putting those variables into the plan, clients see some of the things they might have forgotten to account for, which helps guide decision making,” says Kuansay Khamphilanouvong, Wealth Management Banker with U.S. Bank Wealth Management.

At the end of the day, having a good financial strategy and a good advisory team helps to avoid the potential pitfalls of simply investing home sale proceeds. “There are a lot of things to consider,” says Erenberger, “and our job is to help you make sure you don’t miss those things.”

Learn more about our goals-focused approach to financial planning

Related articles

What should you do with extra cash: Smart things to do with money

Before you use it to treat yourself, consider the ways a cash surplus can help you improve your finances.

Capital gains tax explained

Capital gains tax kicks in when you sell a capital asset and realize a profit. A financial professional can help you design a tax strategy that minimizes your capital gains tax exposure.