What is automatic rebalancing?

When the market changes, stocks, exchange-traded funds (ETFs)1 and other assets are bought and sold in order to reach a target investment allocation. This is called portfolio rebalancing. The goal of rebalancing your portfolio is to reduce volatility and help manage risk.

Why automatic rebalancing matters

- Always-on rebalancing is a key benefit to Automated Investor. It helps you maintain a targeted portfolio and minimizes your exposure to volatility and risk so your money is working for you as you work towards your goals.

- Over time, your portfolio will change due to market movements. For example, your stock portion may have higher returns than your bond portion (or vice versa), leaving your portfolio out of its original alignment, and with more concentrated positions, which can increase volatility and risk. This is called “drift.”

- Our automatic rebalancing tool will review your portfolio each trading day and make adjustments as needed to keep your portfolio invested how you want it to be.

How you can save with automatic rebalancing

Portfolio rebalancing comes with potential benefits, such as:

No transaction fees

Portfolio rebalancing is included as part of Automated Investor's online investing service. That means you don't pay any additional transaction or management fees as your portfolio is automatically rebalanced.

Tax-efficient

Automated Investor avoids capital gains where possible if the assets aren't in a tax-advantaged account, such as an IRA. This limits the capital gains tax that may be due if the asset sold has appreciated in value.

Time and effort

Automated Investor efficiently and automatically rebalances your portfolio so you don't have to. This saves you time and the hassle of having to constantly monitor your account and research when and what adjustments are needed.

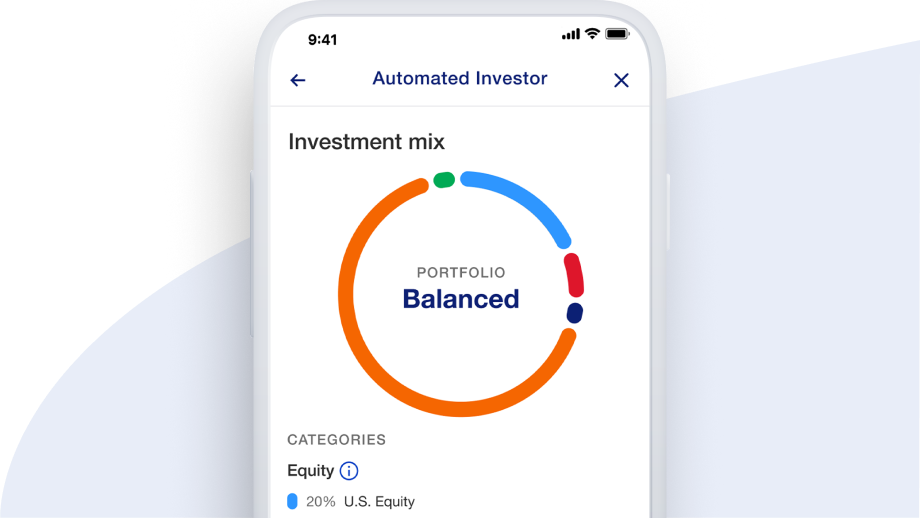

How rebalancing works with Automated Investor

Weighing costs and benefits

Automated Investor uses an algorithm that identifies the benefits of automatic rebalancing. It is then determined if transactions are needed to maintain your target investment mix.

Allowing drift

We allow some drift so we can capture returns and calculate whether the benefit of automatic rebalancing makes sense based on your goals.

Investing in off-target asset classes

Any new contributions and dividends are invested in asset classes that are furthest away from the target investment mix to bring the portfolio back in balance.

Market-based rebalancing

Automated Investor rebalances your portfolio based on market movements.

An example of how rebalancing makes a difference

- A $100 portfolio has a target asset allocation of an 65/35 stock/bond split, or $65 in stocks and $35 in bonds. This is considered an on-target portfolio.

- If throughout the year, stocks return 35% and bonds return 2%, stocks are now worth $87.75 (65 x 1.35) and make up 71% of your portfolio, while bonds are worth $35.70 (35 x 1.02) and make up 29%.

- This investment portfolio is no longer in balance with its 65/35 target asset allocation. Because it has more stocks than it should, it's taking on higher risk. In addition, specific positions can increase in concentration, resulting in higher volatility.

Get started with Automated Investor

If you're ready to take advantage of a portfolio that's automatically rebalanced for you, log into usbank.com or call 866-758-8655 to open an Automated Investor account.

Automated Investor is currently available exclusively for customers of U.S. Bancorp Investments and our affiliate U.S. Bank.