In the early 1980s, Roger Fisher, William Ury, and Bruce Patton introduced the seminal concept “Best Alternative to a Negotiated Agreement” or BATNA, which later appeared in the book Getting to Yes: Negotiating Without Giving In. The basic concept rests in what you are left with should a counterparty refuse to negotiate with you. If you complain that your local dry cleaner’s prices are too high and they refuse your attempt to haggle, you either pay their prices or you buy some starch, heat up the iron and do it yourself. Should your lawn service miss edge work or come infrequently, you either search for another or again, switch to self-service should they not offer a guarantee of improved outcomes. Very simply, a BATNA represents your walk-away options from further negotiations with a given counterparty.

Fisher, Ury and Patton formally call a BATNA “the only standard which can protect you both from accepting terms that are too unfavorable and from rejecting terms it would be in your interest to accept.”1 The BATNA concept resonates given how prominent tariff negotiations are to capital markets, particularly between the United States and China. Recent news of a 90-day tariff pause elicited a strong rally in risk assets ranging from domestic technology stocks to consumer-sensitive retail stocks while haven assets like gold and bonds fell in price. The risk asset rally harkened the April 9th pause to reciprocal tariffs with the rest of the world except China, when the S&P 500 experienced a greater than 10% intraday reversal. What can BATNAs inform us about these dramatic policy reversals?

We frame the policy sequence as follows:

- The United States produced a reciprocal tariff list on a per-country basis on April 2nd following the U.S. equity and bond market close, and the U.S. administration emphasizes onshoring domestic manufacturing as a key objective.

- Asset prices plummeted, especially stocks but bonds too, with the S&P 500 falling close to 20% from late February to intraday on April 9th.

- President Trump announces a 90-day pause to reciprocal tariffs beginning April 9th for all countries except China. The equity market rips higher and bond yields (which move in the opposite direction to prices) calm.

- Trade negotiations begin, with very deliberate information flow on progress until a U.K. trade deal contour announcement on May 8th.

- On Sunday, May 11th, the White House announces a “trade deal” between the U.S. and China, promising further details on May 12th. On May 12th, a joint statement revealed the U.S. decreasing trade duties from 145% to 30% on China, and China reducing U.S. levies to 10% on most goods.

Recent news of a 90-day tariff pause elicited a strong rally in risk assets ranging from domestic technology stocks to consumer-sensitive retail stocks while haven assets like gold and bonds fell in price.

Irrespective of one’s political views, China and the United States have had a codependent relationship for several years: China produces inexpensive goods, and the U.S. is their primary export market. Relative to many western economies, China has struggled to develop recurring consumer demand; while U.S. consumers represent almost two thirds of Gross Domestic Product (GDP), whereas in China, it has averaged less than 40%.2 When the current administration emphasized domestic manufacturing as a core vision, investors rejected the concept, anticipating upfront costs to businesses and consumers despite potential for benefits like increased domestic employment.

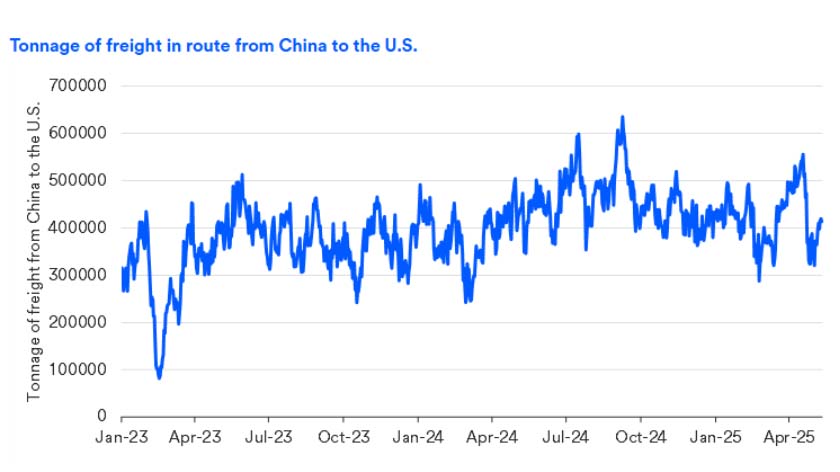

While we will never know how either the U.S. or China views their BATNAs during these negotiations until after the fact (if at all), the following chart represents data that likely served to at least partially motivate both countries.

High frequency supply data: Freight shipments from China to the U.S. dropped

Shipping activity from China to the U.S. slowed from the high end of normal to the low end of normal after escalating tariff announcements.

It is one thing to have a war of words, but Chinese exporters seeing their cost structures increase to a point where they cannot ship competitively priced products to the U.S., and American retailers warning the administration of barren shelves and less consumer choice probably served as motivators to get to the negotiation table. To be sure, this announcement does not represent a bona fide trade deal but instead suspends aggressive tariff levels that perhaps would have led to either party making an adverse selection. Understanding one’s BATNA requires introspection, and neither country can easily extract themselves from their codependence, and markets are not always patient with negotiation duration, particularly should consumers (who were already slowing spending activity) further retrench.

Positioning your portfolio

Our view remains glass half full with respect to diversified portfolios, and the temporary tariff détente represents an opportunity for clients to be introspective and communicative with their feelings throughout the more recent capital market volatility. We find clients sit in one of three defined categories: the first include clients with whom we have engaged in a regular and honest dialogue regarding their risk tolerance, time horizon and liquidity needs. That client cohort is largely in a great position right now, but sharing perspectives around how the most recent market downturn felt is a welcomed dialogue. The second category are those clients sitting in an abundance of cash for whatever reason and have been holding off on adding to their portfolio; we would encourage those in this category to incrementally add to their portfolio as a function of time and price as opposed to trying to time things, as timing can prove elusive (this year is a great example of that phenomenon). The final category represents clients who have been overexposed to risk assets relative to their risk tolerance or liquidity needs, and the recent market gyrations have produced angst, but you have not altered your current capital market orientation. With equity markets demonstrating recent strength, now is a great time to engage with us on finding a portfolio mix more in concert with your unique needs. Your BATNA to not engaging may result in more angst, and we promise it will be a conversation without haggling. We appreciate the trust and opportunity.

Tags:

Explore more

Weekly market analysis

Read the weekly analysis for insights about capital markets, the economy and more.

Access a broad range of investments, vetted by a team of experts.

We can partner with you to design an investment strategy that aligns with your goals and is able to weather all types of market cycles.